ACP stands for, Attorney for Customs Procedure. In Japan, ACP has a role to act for import and export customs procedures on behalf of the non-resident Importer. Let us briefly highlight in which case and why the ACP is necessary for the Japanese trading system.

In principle, Japan Customs does not permit foreign entities to act as the Importer of Record.

However, even such a foreign entity can import as a non-resident importer, if the entity appoints an ACP who can handle the customs procedure on your behalf.

Let’s look at an example. Assuming that a foreign entity wants to ship the goods to an Amazon Fulfillment Center in Japan. Under the Amazon’s FBA program, the consumers are not yet decided at the timing of the import. Therefore, the foreign entity does not have a Japanese resident entity who can act as an importer. Also, Amazon, announces that they won’t become an importer. So, what should they do?

In this case, using ACP is a most straightforward solution. You can import by yourself if you appoint a Japanese resident entity as ACP. Amazon, also releases the guidance to international sellers :

“If you do not have a Japanese entity to act as the importer of record, it is mandatory that you appoint an Attorney for Customs Procedure (ACP). Overseas Sellers, as non-resident importers, can generally rely on a program called ACP to help bring their inventory into Japan. An ACP is a resident Japanese entity who registers with Japan Customs as your agent to help with entries and communications.” – Amazon’s guidance “Understand ACP and IOR guidance”.

Thank you for visiting, please feel free to contact us at any time.

Please be careful, having a proper local ACP (Attorney for Customs Procedures) / IOR (Importer of Record) in Japan is significantly crucial. Without this, your goods will be held up at customs, leading to huge delays and costs. To avoid these risks, we recommend appointing us as your ACP. As professionals in this area, we have a proven track record of successfully resolving numerous cases by working closely with Japan Customs.

YouTube – What is ACP? – Attorney for Customs Procedures

Our ACP Service: The Best Solution for the Japan Importer of Record (IOR)

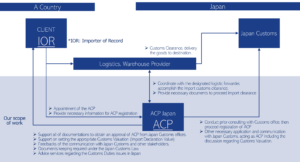

Attorney for Customs Procedures (ACP) is the best solution for addressing the issue of Japan IOR – Importer of Record. Below is an outline of our primary services and a diagram illustrating the operational structure of the ACP service. Upon successful ACP registration, a foreign entity can become the Japan IOR – Importer of Record.

Basic Scope of Services:

- Consultation with the Japan Customs Office for successful ACP registration.

- Liaising with stakeholders, including Logistics Forwarding Companies and the Customs Offices, on behalf of non-resident clients (i.e., non-resident Japan IOR) to ensure the secure importation of goods.

- Assistance in preparing the necessary documentation for import clearance.

- Support of calculation of Customs Value (Customs Valuation Formula), in accordance with appropriate compliance under the Japan Tariff Customs Law.

- Documents keeping, required under article 95 – Japan Customs Law

**Both import and export activities can benefit from the use of an ACP (Attorney for Customs Procedures). This support is applicable in scenarios where a non-resident acts as the Importer of Record (IOR) for imports and as the Exporter of Record (EOR) for exports.

Three Steps to Initiate Shipments Under the ACP Program: :

- Quotation Review to Contract Conclusion: Upon receiving your contact details, we will promptly provide a quotation for your review.

- Commencing the Registration of ACP (Attorney for Customs Procedure) to Japan Customs: This process is generally completed in about two weeks.

- Initiation of First Shipment, Import/Export

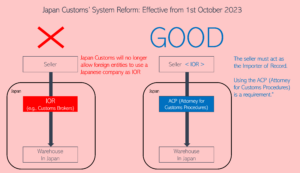

Reform in the Japanese Customs System (Mandatory Use of ACP; IOR services Prohibited)

Effective from October 1, 2023, the Japanese Customs authorities have implemented a significant reform in response to increasing instances where foreign sellers incorrectly designate third parties (like forwarders or customs agents) as importers.

This revision mandates foreign entities to comply with new regulations, which include the compulsory utilization of an Attorney for Customs Procedures (ACP). Under this new framework, it is expressly forbidden for foreign sellers to appoint another Japanese service provider in the role of Importer of Record (IOR).

For additional information, please refer to the following resources:

- Japan Customs: Leaflet(English) Revision of Import Declaration Items and Attorney for Customs Procedure (ACP) System

- English: Announcement from Japan Customs | Directive to use ACP – Attorney for Customs Procedure

*We are pleased to announce that our ACP/IOR services can support the importation of various regulated items, including those under the Food Sanitation Act (such as food products, tableware, cooking utensils and kitchen tools).

Our Customers – Japan IOR / Attorney for Customs Procedures (ACP) Service

All our clients have successfully become Japan Importer of Record (IOR) and imported goods into Japan under our guidance.

Logistics Companies with Collaboration Experience

Here is a list of our partner logistics and forwarding companies with whom we have had successful collaborations. Please note that this list is not exhaustive, as we are open to working with any logistics or forwarding companies. As Attorneys for Customs Procedures (ACP), we represent non-resident clients (IOR) and coordinate with these logistics companies, who manage the transportation of goods to and from Japan.

Why choose us?

- Customs and International Trade Professionals – Our CEO, Mr. Sawada, is a Certified Customs Specialist in Japan. With years of experience providing services in the Trade & Customs field, his leadership at KPMG and the establishment of his own company, SK Advisory, ensures our commitment to excellence and high-quality service.

- Full Adherence to Japanese Customs Law – Our top priority is to maintain full compliance with Japanese Customs Law and safely import / export our clients’ goods into / from Japan. We meticulously manage all import compliance aspects, including Japan Importer of Record (IOR) matter, HS code classification and the correct Customs Valuation of goods entering Japan. We support to complete all the necessary shipping documents, such as Invoice, Packing List and BL, on behald of non-resident / foreign Japan IOR.

- Communication in English, Chinese, and Japanese – Our team, with extensive international experience, excels in communication in English, including facilitating English-language meetings, and has earned considerable trust from clients. We also have staff capable of communicating in Chinese, making us equipped to handle Chinese-language support as well. Naturally, as a Japan-based team, we’re totally fluent in Japanese, ensuring seamless communication across these three key languages.

- Reputable and Reliable Partner -The growing demand for our Attorney for Customs Procedures (ACP) services is testament to our quality. We proudly serve clients globally, registering over 50 ACP customers annually. Our consistent track record underscores our reliability and credibility. For a detailed list of our clientele, please visit our “Experiences” section. Our unwavering commitment ensures all our clients successfully acquire Japan IOR status and import goods seamlessly into Japan.

- Recognized ACP Service Provider on Amazon SPN SPN (Service Provider Network) – We are a certified ACP service provider within Amazon’s Service Provider Network (SPN), listed under the Trade Compliance category. Many international Amazon Sellers have successfully become Japan Importers of Record (IOR) through our ACP services.

Limitations of Using ACP for Specific Goods by Foreign Japan IOR

It’s important to note that ACP may not be suitable for handling certain types of goods. Goods subject to specific regulations, such as the Act on Pharmaceuticals and Medical Devices (including cosmetic items), or PSE/PSC regulations, cannot be imported by appointing ACP. These regulations require importers to be Japanese resident entities.

When a non-resident entity utilizes ACP for their imports, they essentially become the importer. Therefore, for products that fall under the aforementioned regulations, ACP cannot be appointed for importation. To ensure compliance and avoid any restrictions on importing goods, we prioritize checking the eligibility of goods in the first step.

***With our Japanese ACP (Attorney for Customs Procedures) / IOR (Importer of Record) service, we can also support the importation of some other regulated items into Japan (e.g., Food Sanitation Law (food products, tableware, kitchenware, cooking utensils, etc.)).

Japan Consumption Tax (JCT) Compliance

Understanding the handling of JCT (such as payment of import JCT, collection of sales JCT from customers, and JCT returns) is crucial to avoid significant cost burdens. This is a vital aspect, so please ensure a thorough understanding to determine the most optimal business model.

Basic Process of JCT Handling

The JCT treatment for foreign corporations without a base in Japan, importing and then selling in Japan, can be broadly outlined in the following three steps:

- At Import: Pay import VAT (10% of the declared value) to customs – Supported by ACP (Attorney for Customs Procedures)

- At Sale: Collect VAT (10% of sales) from customers

- Final Tax Return (usually annually): Deduct the import VAT paid (step 1) from the JCT collected from customers (step 2), and pay or receive the difference to/from the tax office – Supported by a Tax Representative (Certified Tax Accountant)

Note: Using ACP to become the importer (IOR) is essential for JCT deductions and refunds. If another company acts as the IOR, you cannot deduct the input tax (step 1), and must pay the entire VAT collected (step 2) to the national tax authorities, leading to significant costs.

If you are a JCT-exempt business, the process ends at steps 1 and 2. For taxable businesses or invoice-registered businesses, step 3 (Final Tax Return) is obligatory.

In the Final Tax Return (step 3), if the JCT paid (step 1) exceeds the provisional JCT received (step 2), the difference is refunded. Conversely, if the provisional JCT received (step 2) exceeds the JCT paid (step 1), the difference must be paid to the tax office.

Is Being the Importer Important?

It is very important. Without acting as the importer (IOR) through ACP (Attorney for Customs Procedures), you cannot deduct input tax in step 3. You must pay the full amount of JCT collected in step 2 to the tax office, with no possibility of a refund, resulting in substantial costs. Be careful not to let another company act as the importer.

Are we a Tax-Exempt Business?

Firstly, the JCT collected from customers in step 2 is typically payable to the national tax authorities. JCT applies to asset transfers conducted domestically in Japan by businesses, hence even non-residents are subject to JCT taxable sales transaction.

However, there are cases where payment to the tax office is not necessary, such as for tax-exempt businesses. For instance, businesses newly operating in Japan or small-scale businesses with annual domestic sales (taxable sales in the base period) less than 10 million yen may be exempt from tax obligations.

The general criteria are as follows:

- Invoice-qualified businesses: Tax obligation present – Final Tax Return (step 3) required

- Sales exceeding 10 million yen in the base period (roughly two fiscal years prior): Tax obligation present – Final Tax Return required

- Sales below 10 million yen in the base period but exceeding 10 million yen in a specific period (first six months of the previous fiscal year): Tax obligation present – Final Tax Return required

- Sales below 10 million yen in the base period (and the first six months of the previous fiscal year): No tax obligation – Final Tax Return not required

| JCT taxable sales in the Base Period | JCT taxable sales in the Specified Period | Taxable Entity or Exempt Entity |

| Registered Invoice Issuer |

Taxable Entity | |

| Over 10 million JPY | – | Taxable Entity |

| Equivalent or less than 10 million JPY | Over 10 million JPY | Taxable Entity |

| Equivalent or less than 10 million JPY | Exempt Entity | |

(*1) The base period generally means the fiscal year 2 years prior to the current fiscal year.

(*2) The specified period generally means the first 6 months of the previous fiscal year.

(Note) Regardless of whether or not a company is a JCT-Taxable company, the company (Importer of products) has to pay import JCT to Japan Customs office when the company imports a product.

Please refer to the Tax Authority’s guideline (page3), you can see what is “BASE PERIOD”. general_00.pdf (nta.go.jp)

Also check this website (No.6 Taxable Person): Basic knowledge|National Tax Agency (nta.go.jp)

Can Tax-Exempt Businesses Receive Refunds?

Yes, it’s possible, but a final tax return (step 3) is necessary. Even if you’re an exempt business, you are still able to opt to submit a “Taxable Business Selection Notification” to the tax office, intentionally becoming a taxable business to file a final tax return and receive a refund for the paid import JCT. This is applicable only if the JCT paid at import (step 1) exceeds the provisional JCT collected (step 2). Note that using an ACP (Attorney for Customs Procedures) to act as the importer is essential for input tax deduction and refunds.

Is It Better to Become a Registered Invoice Issuer?

This depends on individual circumstances, but generally speaking, for B2B where customers are corporations, it’s better to be a Registered Invoice Issuer (as corporations file JCT returns and need qualified invoices for input tax deductions). For B2C where customers are primarily consumers, the necessity is somewhat reduced (as most consumers do not file JCT returns).

Many companies seem to become Registered Invoice Issuer without fully understanding the system. Being a registered business mandates the filing of a final tax return (step 3). Please seek advice from appropriate experts.

Is Support from a Certified Tax Accountant Necessary?

For non-residents conducting tax office procedures (step 3) in Japan, appointing a Tax Representative is required. The ACP handles customs procedures, while the Tax Representative deals with national tax (tax office) matters. Under the Certified Tax Accountant Act, the following tasks are exclusively performed by the Certified Tax Accountants, making their support essential:

- Preparation of tax documents

- Tax representation

- Tax consultation

Our company, in partnership with Certified Tax Accountants skilled in international taxation, will provide support in these areas.

How to determine the Import Declaration Value?

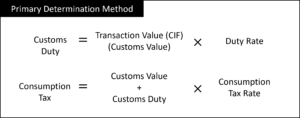

Primary determination method

The process of determining the Import Declaration Value of imported goods is known as “Customs Valuation.” In most cases, when an import is based on an “Import Transaction”※1 between an overseas seller and a buyer in Japan, the primary determination method can be utilized.

※1:An “Import transaction” refers to a transaction where a buyer in Japan engages in a sales transaction with an overseas seller for the purpose of shipping goods to Japan, and the goods subsequently arrive in Japan.

Under the primary determination method, the Customs value of the imported goods is determined as the transaction price paid by the buyer (CIF basis).

Customs Duty is calculated by multiplying the Customs Value (Transaction Value) by the Duty Rate, which varies depending on the HS code of the goods.

Consumption Tax, on the other hand, is calculated by multiplying the Customs Value plus Customs Duty by the Consumption Tax rate (currently 10%).

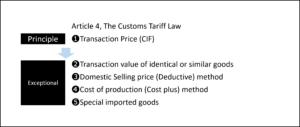

Exceptional determination method (e.g. when to use ACP)

In cases where a non-resident company imports goods into Japan without engaging in a sales transaction, the primary method cannot be utilized. Simply using an Invoice Value is not appropriate.

To calculate the Customs Value in such situations, it is necessary to apply the Exceptional Determination Method.

Within the exceptional determination method, several methods can be considered:

- Transaction Value of Identical or Similar Goods Method: If you have previously imported goods that possess identical or similar conditions to the goods in question, the transaction value of those goods can be used.

- Domestic Selling Price Method (Deductive Method): If you can identify the sales price (can be an estimated sales price), the domestic selling price method can be employed.

- Cost of Production Method (Cost plus Method): If the exporter is a manufacturer and can provide production costs, the production cost method may be applicable.

If none of the above methods are suitable, “Other methods” are utilized as a flexible determination method, taking into account the calculation methods mentioned earlier.

In the practical scene, most of the cases we use this “Other methods” which is a determination method in a flexible way through considering the previously mentioned calculation methods.

Avoiding Customs Valuation Problems

In recent times, there have been numerous instances of trouble arising from incorrect Customs Value settings.

In the worst-case scenario, goods may fail to clear customs, resulting in significant detention fees and eventual return shipment.

At ACP Japan, we specialize in establishing appropriate Customs Values. We can assist in conducting consultations with Japan Customs on behalf of our clients, effectively avoiding any potential issues down the line.

For Amazon’s FBA business, there is a recommended calculation formula for the declaration value. If you would like to learn more about it, please don’t hesitate to contact us!

FAQ for ACP (Attorney for Customs Procedures)

What is the role of ACP (ACP Japan)?

- Representation: ACP (ACP Japan) represents the foreign importer and liaises with Japan Customs and the Forwarding Company/Customs Broker.

- Documentation and Compliance: ACP assists in preparing essential import documents (e.g., Invoices) in compliance with Japan Customs Law and formally requests the Customs Broker to proceed with customs clearance.

- Expert Consultation and Troubleshooting: We are a team of legal experts in Customs Laws, providing direct consultations with Japan Customs to ensure compliance and address issues, including troubleshooting unique challenges in non-resident imports.

How long time does it require to get ACP’s registration?

It will take approximately 2 weeks until getting an approval from Japan Customs Office.

The breakdown of the task is as follows.

- Prepare the necessary documentation between us

- Start pre-consultation with Japan Customs Office and proceed initial review

- Submit paper-based set of application documents to Japan Customs Office for final review

What kind of documents to be necessary for ACP application?

Not limited, but for instance – Power of Attorney, Company Registry, The calculation method of Customs Valuation, Catalog of the import goods, business/logistic flow

ACP can handle all kinds of goods?

ACP, is not capable to handle all kinds of goods. If the goods are subject to specific regulations requires importer to be resident in Japan, such goods can not be handled under the ACP. Restricted regulations are, for instance, Act on Pharmaceuticals and Medical Devices, or PSE/PSC.

Which regions in Japan are we covering?

Any region in Japan, we can handle.

What is difference between ACP and IOR?

ACP is not the Importer. ACP enables non-resident entities to become IOR (Importer of Record).

[Our Service]

Our ACP Service for Importer of Record (IOR)

Our ACP Service for Exporter of Record (EOR)

[Knowledge Pages]

What is ACP? – Attorney for Customs Procedures

Steps of using ACP, how foreign entity can import into Japan by ACP

What is IOR? – Importer of Record

Customs Valuation System in Japan

Customs Valuation When You Import By ACP

[Recent Updates]

ACP Japan Became Amazon’s SPN Provider as Qualified ACP Service Provider

Taxes on Imports: Customs Duty and Japan Consumption Tax (JCT)

Import Permit Document and Alert on IOR Service

New Japan Qualified Invoice System and import JCT (Japan Consumption Tax)