What is an Exporter of Record (EOR) in Japan?

For exporting goods from Japan, it is required to designate a Japan Exporter of Record (EOR).

The EOR must typically be a Japanese resident person or entity, bearing responsibility for compliance with export-related regulations.

Japan Customs mandates that the EOR be based in Japan, disallowing foreign entities from fulfilling this role directly.

What is Japan ACP – Attorney for Customs Procedures

Nevertheless, foreign entities can engage in exporting from Japan by appointing an Attorney for Customs Procedure (ACP). This appointment allows the foreign enties to operate as a Non-Resident Exporter (EOR), enabling them to manage exports independently.

The concept is similar for imports. While a non-resident cannot directly become a Japan Importer of Record (IOR), utilizing an ACP enables a foreign entity to assume the role of an IOR equivalently.

Our ACP Service: The Best Solution for the Japan Exporter of Record (EOR)

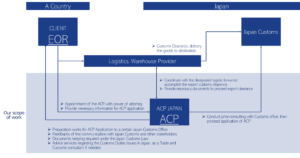

Attorney for Customs Procedures (ACP) is the best solution for addressing the issue of Japan EOR – Exporter of Record. Below is an outline of our primary services and a diagram illustrating the operational structure of the ACP service. Upon successful ACP registration, a foreign entity can become the Japan EOR – Exporter of Record.

Basic Scope of Services:

- Consultation with the Japan Customs Office for successful ACP registration.

- Liaising with stakeholders, including Logistics Forwarding Companies and the Customs Offices, on behalf of non-resident clients (i.e., non-resident Japan IOR) to ensure the secure importation of goods.

- Assistance in preparing the necessary documentation for import clearance.

- Support of calculation of Customs Value (Customs Valuation Formula), in accordance with appropriate compliance under the Japan Tariff Customs Law.

- Security Export Control (Classification for List Control, Examination for Catch-All Control, Application of the license to Ministry of Economy, Trade and Industry)

- Documents keeping, required under article 95 – Japan Customs Law

- Providing professional trade/customs advice if any issues arise.

**Both import and export activities can benefit from the use of an ACP (Attorney for Customs Procedures). This support is applicable in scenarios where a non-resident acts as the Importer of Record (IOR) for imports and as the Exporter of Record (EOR) for exports.

Three Steps to Initiate Shipments Under the ACP Program: :

- Quotation Review to Contract Conclusion: Upon receiving your contact details, we will promptly provide a quotation for your review.

- Commencing the Registration of ACP (Attorney for Customs Procedure) to Japan Customs: This process is generally completed in about two weeks.

- Initiation of First Shipment, Import/Export

Our Customers – Japan IOR / Attorney for Customs Procedures (ACP) Service

All our clients have successfully become Japan Importer of Record (IOR) and imported goods into Japan under our guidance.

Logistics Companies with Collaboration Experience

Here is a list of our partner logistics and forwarding companies with whom we have had successful collaborations. Please note that this list is not exhaustive, as we are open to working with any logistics or forwarding companies. As Attorneys for Customs Procedures (ACP), we represent non-resident clients (IOR) and coordinate with these logistics companies, who manage the transportation of goods to and from Japan.

Please Be Careful

In cases where foreign corporations (non-residents) without an office in Japan import goods, failure to properly prepare an Importer of Record (IOR) through an Attorney for Customs Procedures (ACP) or similar means can result in goods being held at customs, leading to significant delays and costs. To avoid such risks, please make thorough preparations.

If an ACP is needed, it is crucial to utilize the services of an experienced ACP well-versed in customs-related laws and regulations. The import and export operations of non-residents/foreign corporations using an ACP are treated as unique cases. Many customs brokers are not familiar with these procedures, leading to incidents where goods are detained for extended periods due to unsuccessful explanations to customs. (Customs will not permit the import if the explanations provided by the importer or customs broker are unsatisfactory, resulting in the goods being detained until customs is convinced.)

We highly recommend utilizing our services as professional experts in customs, knowledgeable about customs-related laws and regulations. With a proven track record of resolving numerous issues through direct consultations with customs officers and customs brokers, our clients supported as an ACP now exceed 100 companies. We are committed to delivering industry-leading results with our expertise.

Why choose us?

- Customs and International Trade Professionals – Our CEO, Mr. Sawada, is a Certified Customs Specialist in Japan. With years of experience providing services in the Trade & Customs field, his leadership at KPMG and the establishment of his own company, SK Advisory, ensures our commitment to excellence and high-quality service.

- Full Adherence to Japanese Customs Law – Our top priority is to maintain full compliance with Japanese Customs Law and safely import / export our clients’ goods into / from Japan. We meticulously manage all import compliance aspects, including Japan Importer of Record (IOR) matter, HS code classification and the correct Customs Valuation of goods entering Japan. We support to complete all the necessary shipping documents, such as Invoice, Packing List and BL, on behald of non-resident / foreign Japan IOR.

- Communication in English, Chinese, and Japanese – Our team, with extensive international experience, excels in communication in English, including facilitating English-language meetings, and has earned considerable trust from clients. We also have staff capable of communicating in Chinese, making us equipped to handle Chinese-language support as well. Naturally, as a Japan-based team, we’re totally fluent in Japanese, ensuring seamless communication across these three key languages.

- Reputable and Reliable Partner -The growing demand for our Attorney for Customs Procedures (ACP) services is testament to our quality. We proudly serve clients globally, registering over 50 ACP customers annually. Our consistent track record underscores our reliability and credibility. Our unwavering commitment ensures all our clients successfully acquire Japan IOR status and import goods seamlessly into Japan.

- Handling Regulated Products – Our ACP/IOR partnership system can manage regulated items, including cosmetics, PSE-products, foodstuffs, and tableware.

- Recognized ACP Service Provider on Amazon SPN (Service Provider Network) – We are a certified ACP service provider within Amazon’s Service Provider Network (SPN), listed under the Trade Compliance category. Many international Amazon Sellers have successfully become Japan Importers of Record (IOR) through our ACP services.

FAQ for ACP (Attorney for Customs Procedures)

What is the role of ACP (ACP Japan)?

- Representation: ACP (ACP Japan) represents the foreign importer and liaises with Japan Customs and the Forwarding Company/Customs Broker.

- Documentation and Compliance: ACP assists in preparing essential import documents (e.g., Invoices) in compliance with Japan Customs Law and formally requests the Customs Broker to proceed with customs clearance.

- Expert Consultation and Troubleshooting: We are a team of legal experts in Customs Laws, providing direct consultations with Japan Customs to ensure compliance and address issues, including troubleshooting unique challenges in non-resident imports.

How long time does it require to get ACP’s registration?

It will take approximately 2 weeks until getting an approval from Japan Customs Office.

The breakdown of the task is as follows.

- Prepare the necessary documentation between us

- Start pre-consultation with Japan Customs Office and proceed initial review

- Submit paper-based set of application documents to Japan Customs Office for final review

What kind of documents to be necessary for ACP application?

Not limited, but for instance – Power of Attorney, Company Registry, The calculation method of Customs Valuation, Catalog of the import goods, business/logistic flow

ACP can handle all kinds of goods?

Whereas many ACP service providers do not handle regulated items, our company’s competitive advantage stems from our ability to manage such products. We can support regulated items, including cosmetics, PSE-regulated products, foodstuffs, and tableware.

Which regions in Japan are we covering?

Any region in Japan, we can handle.

What is difference between ACP and IOR?

ACP is not the Importer. ACP enables non-resident entities to become IOR (Importer of Record).

—–

[Our Service]

Our ACP Service for Importer of Record (IOR)

Our ACP Service for Exporter of Record (EOR)

[Knowledge Pages]

What is ACP? – Attorney for Customs Procedures

Steps of using ACP, how foreign entity can import into Japan by ACP

What is IOR? – Importer of Record

Customs Valuation System in Japan

Customs Valuation When You Import By ACP

Limitation on Handling by ACP in Japan – Our System Enables Us to Handle Regulated Items

[Recent Updates]

ACP Japan Became Amazon’s SPN Provider as Qualified ACP Service Provider

Taxes on Imports: Customs Duty and Japan Consumption Tax (JCT)

Import Permit Document and Alert on IOR Service

New Japan Qualified Invoice System and import JCT (Japan Consumption Tax)