Last Updated on April 28, 2024 by ACP JAPAN

As previously mentioned in another article (“Announcement from Japan Customs | Mandatory to use ACP in Many Cases – Attorney for Customs Procedure”),

from October 2023, overseas sellers, especially those on e-commerce platforms like Amazon, Rakuten, and Shopify, are now necessary to utilize ACP and become the Importer of Record (IOR) themselves. Therefore, schemes involving designating other Japanese corporations as the IOR are no longer feasible. Despite clear directives to this effect, we observe certain IOR businesses providing unauthorized IOR services.

The prevalence of such questionable practices necessitates this article as a cautionary note. Sellers operating in Japan must strive to understand and comply with the correct legal framework and avoid unnecessary penalty.

Problematic Practices – Violation of Customs Laws

There are instances where transactions seem to exist between overseas businesses and Japanese IORs (who are merely importers in name), with manipulated documents like invoices reflecting undervalued declared prices for customs clearance. In reality, these goods are not directly shipped to fulfillment centers like Amazon but temporarily stored in domestic warehouses. Here, they are labeled before being sent to the final fulfillment destination. This scheme aims to avoid detection by customs as e-commerce products. Such actions are illegal and not in compliance with the law, and I strongly urge an immediate cessation of these practices.

Importing through illegal schemes often leads to undervalued import declarations. Even if customs clearance is initially granted, subsequent Post Clearance Audit by customs can lead to substantial penalties. Legally, the IOR is liable for these payments, which can lead to disputes between overseas sellers and IOR businesses. Typically, the financial burden of import duties and taxes falls on the overseas sellers, making conflicts predictable.

Both the uninformed overseas businesses using these illegal schemes and the IOR operators bear responsibility.

Observing extremely low prices for products by overseas sellers on e-commerce platforms like Amazon often gives an impression of an unfair competitive environment. Legitimate overseas businesses pay appropriate taxes and add these costs to their selling prices, putting them at a disadvantage against sellers who avoid proper tax payments. This unfairness is precisely why the customs system was revised in October 2023.

For businesses with low compliance awareness, the issues likely extend beyond just declared values. Often, they might also be non-compliant with intellectual property laws and other regulations.

Concerns Over Cost Impact of Customs Valuation/Import Declarations

When overseas sellers import goods for e-commerce into Japan, whether through ACP or as the another IOR company, there is no “import transaction” with a Japanese buyer, leading to the exceptional determination method for declared import values, typically based on the domestic selling price.

There are concerns about high valuation leading to excessive duties and taxes. However, this is a determination method based on the Customs Tariff Law, which must be adhered to. The cost impact of the valuation is not as significant as often feared.

The taxes on import are mainly customs duties and consumption tax. Japan’s import tariffs are relatively low on a global scale, and many industrial products are duty-free. As for consumption tax, which is a uniform 10%, it is an indirect tax borne by the final consumer, not a cost for the overseas seller. Taxable businesses regularly file consumption tax returns to the tax office, adjusting the tax paid on imports against the tax collected from sales, neutralizing the cost impact. However, this necessitates that the overseas business itself becomes the importer, achievable only through using ACP.

With the start of the consumption tax invoice system in October 2023, many overseas businesses might have registered as qualified invoice-issuing entity. For B2C businesses, registration as a qualified invoice-issuing entity is not always necessary, but many companies seem to register without fully understanding the system. I recommend that overseas businesses seek advice from qualified professionals to navigate these changes correctly.

As seasoned experts in customs and trade facilitation, we at ACP JAPAN are here to navigate these complexities on your behalf. Our approach, grounded in professionalism and profound regulatory knowledge, ensures a seamless, compliant, and strategic entry into Japan’s vibrant market.

We invite you to reach out to us — let’s discuss how we can support your business’s successful and compliant expansion into Japan. Your peace of mind is our top priority.

We look forward to your inquiry!

Our ACP Service: The Best Solution for the Japan Importer of Record (IOR) and Exporter of Record (EOR)

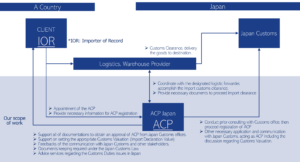

Attorney for Customs Procedures (ACP) is the best solution for addressing the issue of Japan IOR – Importer of Record. Below is an outline of our primary services and a diagram illustrating the operational structure of the ACP service. Upon successful ACP registration, a foreign entity can become the Japan IOR – Importer of Record.

Basic Scope of Services:

- Consultation with the Japan Customs Office for successful ACP registration.

- Liaising with stakeholders, including Logistics Forwarding Companies and the Customs Offices, on behalf of non-resident clients (i.e., non-resident Japan IOR) to ensure the secure importation of goods.

- Assistance in preparing the necessary documentation for import clearance.

- Support of calculation of Customs Value (Customs Valuation Formula), in accordance with appropriate compliance under the Japan Tariff Customs Law.

- Security Export Control (Classification for List Control, Examination for Catch-All Control, Application of the license to Ministry of Economy, Trade and Industry)

- Documents keeping, required under article 95 – Japan Customs Law

- Providing professional trade/customs advice if any issues arise.

**Both import and export activities can benefit from the use of an ACP (Attorney for Customs Procedures). This support is applicable in scenarios where a non-resident acts as the Importer of Record (IOR) for imports and as the Exporter of Record (EOR) for exports.

Three Steps to Initiate Shipments Under the ACP Program: :

- Quotation Review to Contract Conclusion: Upon receiving your contact details, we will promptly provide a quotation for your review.

- Commencing the Registration of ACP (Attorney for Customs Procedure) to Japan Customs: This process is generally completed in about two weeks.

- Initiation of First Shipment, Import/Export

Our Customers – Japan IOR / Attorney for Customs Procedures (ACP) Service

All our clients have successfully become Japan Importer of Record (IOR) and imported goods into Japan under our guidance.

Logistics Companies with Collaboration Experience

Here is a list of our partner logistics and forwarding companies with whom we have had successful collaborations. Please note that this list is not exhaustive, as we are open to working with any logistics or forwarding companies. As Attorneys for Customs Procedures (ACP), we represent non-resident clients (IOR) and coordinate with these logistics companies, who manage the transportation of goods to and from Japan.

Why choose us?

- Customs and International Trade Professionals – Our CEO, Mr. Sawada, is a Certified Customs Specialist in Japan. With years of experience providing services in the Trade & Customs field, his leadership at KPMG and the establishment of his own company, SK Advisory, ensures our commitment to excellence and high-quality service.

- Full Adherence to Japanese Customs Law – Our top priority is to maintain full compliance with Japanese Customs Law and safely import / export our clients’ goods into / from Japan. We meticulously manage all import compliance aspects, including Japan Importer of Record (IOR) matter, HS code classification and the correct Customs Valuation of goods entering Japan. We support to complete all the necessary shipping documents, such as Invoice, Packing List and BL, on behald of non-resident / foreign Japan IOR.

- Communication in English, Chinese, and Japanese – Our team, with extensive international experience, excels in communication in English, including facilitating English-language meetings, and has earned considerable trust from clients. We also have staff capable of communicating in Chinese, making us equipped to handle Chinese-language support as well. Naturally, as a Japan-based team, we’re totally fluent in Japanese, ensuring seamless communication across these three key languages.

- Reputable and Reliable Partner -The growing demand for our Attorney for Customs Procedures (ACP) services is testament to our quality. We proudly serve clients globally, registering over 50 ACP customers annually. Our consistent track record underscores our reliability and credibility. For a detailed list of our clientele, please visit our “Experiences” section. Our unwavering commitment ensures all our clients successfully acquire Japan IOR status and import goods seamlessly into Japan.

- Recognized ACP Service Provider on Amazon SPN SPN (Service Provider Network) – We are a certified ACP service provider within Amazon’s Service Provider Network (SPN), listed under the Trade Compliance category. Many international Amazon Sellers have successfully become Japan Importers of Record (IOR) through our ACP services.

Please Be Careful

In cases where foreign corporations (non-residents) without an office in Japan import goods, failure to properly prepare an Importer of Record (IOR) through an Attorney for Customs Procedures (ACP) or similar means can result in goods being held at customs, leading to significant delays and costs. To avoid such risks, please make thorough preparations.

If an ACP is needed, it is crucial to utilize the services of an experienced ACP well-versed in customs-related laws and regulations. The import and export operations of non-residents/foreign corporations using an ACP are treated as unique cases. Many customs brokers are not familiar with these procedures, leading to incidents where goods are detained for extended periods due to unsuccessful explanations to customs. (Customs will not permit the import if the explanations provided by the importer or customs broker are unsatisfactory, resulting in the goods being detained until customs is convinced.)

We highly recommend utilizing our services as professional experts in customs, knowledgeable about customs-related laws and regulations. With a proven track record of resolving numerous issues through direct consultations with customs officers and customs brokers, our clients supported as an ACP now exceed 100 companies. We are committed to delivering industry-leading results with our expertise.

FAQ for ACP (Attorney for Customs Procedures)

What is the role of ACP (ACP Japan)?

- Representation: ACP (ACP Japan) represents the foreign importer and liaises with Japan Customs and the Forwarding Company/Customs Broker.

- Documentation and Compliance: ACP assists in preparing essential import documents (e.g., Invoices) in compliance with Japan Customs Law and formally requests the Customs Broker to proceed with customs clearance.

- Expert Consultation and Troubleshooting: We are a team of legal experts in Customs Laws, providing direct consultations with Japan Customs to ensure compliance and address issues, including troubleshooting unique challenges in non-resident imports.

How long time does it require to get ACP’s registration?

It will take approximately 2 weeks until getting an approval from Japan Customs Office.

The breakdown of the task is as follows.

- Prepare the necessary documentation between us

- Start pre-consultation with Japan Customs Office and proceed initial review

- Submit paper-based set of application documents to Japan Customs Office for final review

What kind of documents to be necessary for ACP application?

Not limited, but for instance – Power of Attorney, Company Registry, The calculation method of Customs Valuation, Catalog of the import goods, business/logistic flow

ACP can handle all kinds of goods?

ACP, is not capable to handle all kinds of goods. If the goods are subject to specific regulations requires importer to be resident in Japan, such goods can not be handled under the ACP. Restricted regulations are, for instance, Act on Pharmaceuticals and Medical Devices, or PSE/PSC.

Which regions in Japan are we covering?

Any region in Japan, we can handle.

What is difference between ACP and IOR?

ACP is not the Importer. ACP enables non-resident entities to become IOR (Importer of Record).

—–

[Our Service]

Our ACP Service for Importer of Record (IOR)

Our ACP Service for Exporter of Record (EOR)

[Knowledge Pages]

What is ACP? – Attorney for Customs Procedures

Steps of using ACP, how foreign entity can import into Japan by ACP

What is IOR? – Importer of Record

Customs Valuation System in Japan

Customs Valuation When You Import By ACP

[Recent Updates]

ACP Japan Became Amazon’s SPN Provider as Qualified ACP Service Provider

Taxes on Imports: Customs Duty and Japan Consumption Tax (JCT)

Import Permit Document and Alert on IOR Service

New Japan Qualified Invoice System and import JCT (Japan Consumption Tax)