Last Updated on May 2, 2024 by ACP JAPAN

Exporters shipping goods from Japan are required to verify whether the exported goods or transactions are subject to security export control regulations. Exporters must prepare the necessary classification documents (Certificates of Non-Applicability/Applicability) for export customs clearance and, where necessary, obtain permission from the Ministry of Economy, Trade and Industry.

Compliance with list control and catch-all control regulations, as defined in the Foreign Exchange and Foreign Trade Act, Export Order, Foreign Exchange Order, and the Order Concerning Export, etc., is mandatory. There are also penalties for non-compliance.

Our company supports many foreign corporations (exporters and importers) based outside Japan as an Attorney for Custms Procedures (ACP). Acting as an ACP for the foreign corporations, we handle customs procedures as well as tasks required under security export control, including determination of list control compliance, transaction reviews under catch-all regulations, and applications for permits from the Ministry of Economy, Trade and Industry.

With the increase in export cases, we have established a business process for security export control that meets the “Compliance Standards for Exporters, etc.: I Standards of Compliance for Exporters, II Standards of Compliance for Export of Controlled Items,” as stipulated by law.

As a professional Attorney for Customs Procedures, we are committed to properly adhering to various compliance requirements.

Reference: Ministry of Economy, Trade and Industry, Security Trade Control Guidance (Link)

Various Laws to Consider When Exporting

Customs Law Related:

– Customs Law: Prohibited items (narcotics, child pornography, items infringing intellectual property rights, copies, imitations, etc.).

Security Trade Control (Export Control) Related:

– Export Trade Control Order: Goods

– Foreign Exchange Order: Services (technology)

Other Laws Related:

– Cultural Property Protection Law

– Wildlife Protection and Hunting Law

– Livestock Infectious Disease Prevention Law

– Rabies Prevention Law

– Plant Quarantine Law

– Road Transport Vehicle Law

– Narcotics and Psychotropic Drugs Control Law, Cannabis Control Law, Opium Law, Stimulants Control Law

Framework of Security Trade Control Regulations

1) List Control:

Prohibited goods and technologies that should not be exported (advanced technology, dual-use risks):

– Goods: Items 1 to 15 in Schedule 1 of the Export Trade Control Order.

– Services: Items 1 to 15 in Schedule of the Foreign Exchange Order.

2) Catch-All Controls:

Prohibited export recipients (UN arms embargo countries or concerning individuals/organizations):

– Goods: Item 16 in Schedule 1 of the Export Trade Control Order “All except food and wood.”

– Services: Item 16 in Schedule of the Foreign Exchange Order “Technologies related to all except food and wood.”

Penalties Related to Export Control

Criminal Penalties (Maximum):

– Up to 10 years imprisonment

– Fine up to 1 billion yen (for corporations)

– Fine up to 30 million yen (for individuals)

Administrative Penalties:

– Prohibition on exporting goods or providing technology for up to 3 years

– Prohibition from taking executive positions in other companies

Export Control Procedures

Step-1: Yes-No Determination

Determine whether the goods or technology to be exported falls under the “List Control” goods etc.

– Specific items are listed in “Schedule 1 of the Export Order” or “Schedule of the Foreign Exchange Order”, and their specific specifications are confirmed in “Goods etc. Ministerial Ordinance”.

– Item verification: Match export items against the contents of Schedule 1 of the Export Order or the Foreign Exchange Order.

– Specification verification: Match against the Goods etc. Ministerial Ordinance. The “Goods & Technology Matrix Table” on the Ministry of Economy, Trade and Industry website is helpful for matching export item specifications.

– Using the “Item-by-Item Comparison Table” or “Parameter Sheet” can be more efficient. Available for purchase from the CISTEC website.

– If not applicable, a non-applicable certificate is created.

Step-2: Transaction Examination

Check who the counterpart is (inquirer, end-user), and what the uses are to decide whether to proceed with the transaction.

(1) “End-Use & End-User” verification and decision.

(2) Decision on the applicability of “Exception Provisions” (such as gratuitous exception, small amount exception).

(3) Decision on the applicability of “General Permit”.

(4) Check concerning Catch-All Controls.

→ If necessary, apply for individual permission from the Ministry of Economy, Trade and Industry.

Step-3: Shipping Management, Export

– Ensure that the Yes-No Determination and Transaction Examination are properly completed.

– Verify that the goods or technology to be exported is the same as what was determined and examined.

– If a permit is required for export, ensure it is obtained.

Export Permit Application

When exporting goods or providing technology that falls under regulation, it is necessary to obtain prior permission from the Ministry of Economy, Trade and Industry (normally, electronic application through NACCS).

Compliance with Export Control Standards (enacted April 2010)

– Those engaged in exporting or providing technology as a business (exporters etc.) must comply with the Exporter Compliance Standards according to Article 55-10, Paragraph 4 of the Foreign Exchange Law.

– Exporters etc. dealing with security-sensitive specified important goods (List Control items) must comply with Standards I and II. Those not dealing with such items must comply with Standard I only.

Tips for Export Management (Utilization of Forms)

By establishing and utilizing company-specific forms (formats), export management tasks can be securely implemented, and illegal exports can be prevented.

Form Examples:

– Yes-No Determination: Yes-No Determination Form

– Transaction Examination: Use Checklist, End-User Checklist, Clear Guideline Sheet, Transaction Examination Form

– Shipping Management: Shipping Checklist

Reference: Ministry of Economy, Trade and Industry Security Trade Control Guidance Materials

Gratuitous Exception (exemptions where permit application is waived)

Gratuitous Notice: Goods imported gratuitously as specified by the Minister of Economy, Trade, and Industry under Article 4, Paragraph 1, Item Ho and He of the Export Trade Control Order.

Goods imported gratuitously and returned gratuitously (9 cases extracted):

– Goods exported from Japan that are repaired in Japan and re-exported.

– Goods exhibited at exhibitions held in Japan from abroad.

– Goods imported through an ATA Carnet for temporary import.

– Items carried by persons temporarily entering and leaving the country for personal use.

– Goods imported for the purpose of transporting other goods.

Goods to be exported gratuitously as specified (7 cases extracted):

– Goods exported by the International Emergency Assistance Team for use in international emergency assistance activities.

– Goods exported by experts dispatched by the Japan International Cooperation Agency for their use.

– Items carried by persons temporarily leaving the country for personal use.

– Goods exported for the purpose of transporting other goods.

Small Amount Exception (exemptions where permit application is waived)

(1) Items under Items 1-4 of Schedule 1 of the Export Order: No application of small amount exception.

(2) Goods under Items 5-13 of Schedule 1 of the Export Order, except below (3): Below 1 million yen.

(3) Goods specified by the Minister of Economy, Trade, and Industry under the provisions of Schedule 3, Item 3 of the Export Order (Schedule 3, Item 3 Notice): Below 50,000 yen.

(4) Goods under Item 14 of Schedule 1 of the Export Order: No application of small amount exception.

(5) Goods under Item 15 of Schedule 1 of the Export Order: Below 50,000 yen.

(6) Goods under Item 16 of Schedule 1 of the Export Order: No application of small amount exception.

Note: If the destination is a concern country (North Korea, Iran, Iraq, etc.), the small amount exception does not apply.

U.S. Export Control Regulations – EAR (Export Administration Regulations)

A feature of the U.S. EAR is its “extraterritorial application”. When U.S.-origin goods or technology exported from the U.S. are re-exported from the importing country, in addition to review under the domestic laws of that country, an export review based on U.S. law is also required. If applicable, permission must be obtained from the U.S. government.

Step-1: Check if the item is subject to EAR regulations (CCL – Commerce Control List).

Step-2: Check if an ECCN (Export Control Classification Number) exists.

Step-3: Check if re-export permission is required.

Step-4: Check if a license exception is applicable.

→ If necessary, apply for permission from the U.S. government.

Our Service – Attorney for Customs Procedures (ACP) for Exporter of Record (EOR)

What is an Exporter of Record (EOR) in Japan?

For exporting goods from Japan, it is required to designate a Japan Exporter of Record (EOR).

The EOR must typically be a Japanese resident person or entity, bearing responsibility for compliance with export-related regulations.

Japan Customs mandates that the EOR be based in Japan, disallowing foreign entities from fulfilling this role directly.

What is Japan ACP – Attorney for Customs Procedures

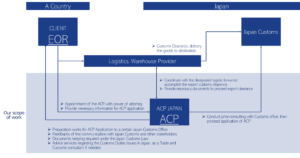

Nevertheless, foreign entities can engage in exporting from Japan by appointing an Attorney for Customs Procedure (ACP). This appointment allows the foreign enties to operate as a Non-Resident Exporter (EOR), enabling them to manage exports independently.

The concept is similar for imports. While a non-resident cannot directly become a Japan Importer of Record (IOR), utilizing an ACP enables a foreign entity to assume the role of an IOR equivalently.

Our ACP Service: The Best Solution for the Japan Exporter of Record (EOR)

Attorney for Customs Procedures (ACP) is the best solution for addressing the issue of Japan EOR – Exporter of Record. Below is an outline of our primary services and a diagram illustrating the operational structure of the ACP service. Upon successful ACP registration, a foreign entity can become the Japan EOR – Exporter of Record.

Basic Scope of Services:

- Consultation with the Japan Customs Office for successful ACP registration.

- Liaising with stakeholders, including Logistics Forwarding Companies and the Customs Offices, on behalf of non-resident clients (i.e., non-resident Japan IOR) to ensure the secure importation of goods.

- Assistance in preparing the necessary documentation for import clearance.

- Support of calculation of Customs Value (Customs Valuation Formula), in accordance with appropriate compliance under the Japan Tariff Customs Law.

- Security Export Control (Classification for List Control, Examination for Catch-All Control, Application of the license to Ministry of Economy, Trade and Industry)

- Documents keeping, required under article 95 – Japan Customs Law

- Providing professional trade/customs advice if any issues arise.

**Both import and export activities can benefit from the use of an ACP (Attorney for Customs Procedures). This support is applicable in scenarios where a non-resident acts as the Importer of Record (IOR) for imports and as the Exporter of Record (EOR) for exports.

Three Steps to Initiate Shipments Under the ACP Program: :

- Quotation Review to Contract Conclusion: Upon receiving your contact details, we will promptly provide a quotation for your review.

- Commencing the Registration of ACP (Attorney for Customs Procedure) to Japan Customs: This process is generally completed in about two weeks.

- Initiation of First Shipment, Import/Export

Our Customers – Japan IOR / Attorney for Customs Procedures (ACP) Service

All our clients have successfully become Japan Importer of Record (IOR) and imported goods into Japan under our guidance.

Logistics Companies with Collaboration Experience

Here is a list of our partner logistics and forwarding companies with whom we have had successful collaborations. Please note that this list is not exhaustive, as we are open to working with any logistics or forwarding companies. As Attorneys for Customs Procedures (ACP), we represent non-resident clients (IOR) and coordinate with these logistics companies, who manage the transportation of goods to and from Japan.

Please Be Careful

In cases where foreign corporations (non-residents) without an office in Japan import goods, failure to properly prepare an Importer of Record (IOR) through an Attorney for Customs Procedures (ACP) or similar means can result in goods being held at customs, leading to significant delays and costs. To avoid such risks, please make thorough preparations.

If an ACP is needed, it is crucial to utilize the services of an experienced ACP well-versed in customs-related laws and regulations. The import and export operations of non-residents/foreign corporations using an ACP are treated as unique cases. Many customs brokers are not familiar with these procedures, leading to incidents where goods are detained for extended periods due to unsuccessful explanations to customs. (Customs will not permit the import if the explanations provided by the importer or customs broker are unsatisfactory, resulting in the goods being detained until customs is convinced.)

We highly recommend utilizing our services as professional experts in customs, knowledgeable about customs-related laws and regulations. With a proven track record of resolving numerous issues through direct consultations with customs officers and customs brokers, our clients supported as an ACP now exceed 100 companies. We are committed to delivering industry-leading results with our expertise.

Why choose us?

- Customs and International Trade Professionals – Our CEO, Mr. Sawada, is a Certified Customs Specialist in Japan. With years of experience providing services in the Trade & Customs field, his leadership at KPMG and the establishment of his own company, SK Advisory, ensures our commitment to excellence and high-quality service.

- Full Adherence to Japanese Customs Law – Our top priority is to maintain full compliance with Japanese Customs Law and safely import / export our clients’ goods into / from Japan. We meticulously manage all import compliance aspects, including Japan Importer of Record (IOR) matter, HS code classification and the correct Customs Valuation of goods entering Japan. We support to complete all the necessary shipping documents, such as Invoice, Packing List and BL, on behald of non-resident / foreign Japan IOR.

- Communication in English, Chinese, and Japanese – Our team, with extensive international experience, excels in communication in English, including facilitating English-language meetings, and has earned considerable trust from clients. We also have staff capable of communicating in Chinese, making us equipped to handle Chinese-language support as well. Naturally, as a Japan-based team, we’re totally fluent in Japanese, ensuring seamless communication across these three key languages.

- Reputable and Reliable Partner -The growing demand for our Attorney for Customs Procedures (ACP) services is testament to our quality. We proudly serve clients globally, registering over 50 ACP customers annually. Our consistent track record underscores our reliability and credibility. Our unwavering commitment ensures all our clients successfully acquire Japan IOR status and import goods seamlessly into Japan.

- Handling Regulated Products – Our ACP/IOR partnership system can manage regulated items, including cosmetics, PSE-products, foodstuffs, and tableware.

- Recognized ACP Service Provider on Amazon SPN (Service Provider Network) – We are a certified ACP service provider within Amazon’s Service Provider Network (SPN), listed under the Trade Compliance category. Many international Amazon Sellers have successfully become Japan Importers of Record (IOR) through our ACP services.

FAQ for ACP (Attorney for Customs Procedures)

What is the role of ACP (ACP Japan)?

- Representation: ACP (ACP Japan) represents the foreign importer and liaises with Japan Customs and the Forwarding Company/Customs Broker.

- Documentation and Compliance: ACP assists in preparing essential import documents (e.g., Invoices) in compliance with Japan Customs Law and formally requests the Customs Broker to proceed with customs clearance.

- Expert Consultation and Troubleshooting: We are a team of legal experts in Customs Laws, providing direct consultations with Japan Customs to ensure compliance and address issues, including troubleshooting unique challenges in non-resident imports.

How long time does it require to get ACP’s registration?

It will take approximately 2 weeks until getting an approval from Japan Customs Office.

The breakdown of the task is as follows.

- Prepare the necessary documentation between us

- Start pre-consultation with Japan Customs Office and proceed initial review

- Submit paper-based set of application documents to Japan Customs Office for final review

What kind of documents to be necessary for ACP application?

Not limited, but for instance – Power of Attorney, Company Registry, The calculation method of Customs Valuation, Catalog of the import goods, business/logistic flow

ACP can handle all kinds of goods?

Whereas many ACP service providers do not handle regulated items, our company’s competitive advantage stems from our ability to manage such products. We can support regulated items, including cosmetics, PSE-regulated products, foodstuffs, and tableware.

Which regions in Japan are we covering?

Any region in Japan, we can handle.

What is difference between ACP and IOR?

ACP is not the Importer. ACP enables non-resident entities to become IOR (Importer of Record).

—–

[Our Service]

Our ACP Service for Importer of Record (IOR)

Our ACP Service for Exporter of Record (EOR)

[Knowledge Pages]

What is ACP? – Attorney for Customs Procedures

Steps of using ACP, how foreign entity can import into Japan by ACP

What is IOR? – Importer of Record

Customs Valuation System in Japan

Customs Valuation When You Import By ACP

Limitation on Handling by ACP in Japan – Our System Enables Us to Handle Regulated Items

[Recent Updates]

ACP Japan Became Amazon’s SPN Provider as Qualified ACP Service Provider

Taxes on Imports: Customs Duty and Japan Consumption Tax (JCT)

Import Permit Document and Alert on IOR Service

New Japan Qualified Invoice System and import JCT (Japan Consumption Tax)