Last Updated on May 5, 2024 by ACP JAPAN

Import Declaration Value Assessment for Amazon FBA Shipments to Japan

Fundamentals of Calculating Import Declaration Values Based on Japan’s Customs Tariff Law

Overview of customs valuation methodology:

Typically, for importations that involve a purchasing agreement between an overseas seller and a Japanese buyer who also acts as the importer, the declaration value can be based on the CIF sales transaction price. This method is recognized as the primary determination method under Customs Tariff Law Article 4, Paragraph 1.

In instances involving Amazon FBA, where Amazon International Sellers send their products to an Amazon FC warehouse in Japan without transferring ownership, the primary method is not applicable. Consequently, a special determination method must be applied as outlined in Customs Tariff Law Article 4-2 and subsequent sections.

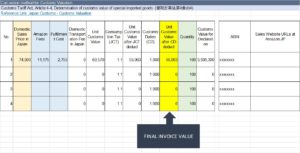

For Amazon FBA shipments, the import declaration value is usually set by a special method detailed in Customs Tariff Law Article 4-4, which calculates the taxable value for special import goods using the domestic sales price determination method of Article 4-3. This process includes subtracting specific local expenses (such as import duties, consumption tax, Amazon Referral Fee, Amazon FBA Fee, and domestic transportation costs) from the domestic sales price, a technique referred to as the Deductive Method.

Deductive Valuation Technique

The deductive valuation process, based on the domestic sales price, is outlined as follows:

Step 1) Subtract Amazon Fees, Fulfillment Costs, and Other Domestic Fees (e.g., Domestic Transport, Clearance charge) from the Domestic Sales Price.

Example: Sales Price 74,500 JPY – Total Fees 13,930 JPY = 60,570 JPY

Step 2) Adjust the result from step 1 for the 10% Japan Consumption Tax and any applicable customs duty rate.

Example: 60,570 JPY ÷ 110% = 55,063 JPY

This results in 55,063 JPY being the per product import declaration value.

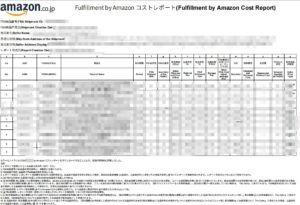

Required Screenshots for Validation of Sales Price and Fees

Japan Customs mandates the provision of screenshots as proof of the Sales Price and deducted fees.

Evidence of Sales Price: Obtain this from the Amazon Sales Page at [www.amazon.co.jp/dp/ASIN NUMBER]

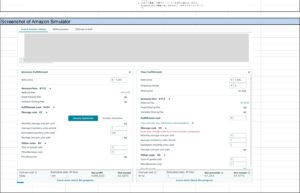

Amazon Seller Central Simulator: Capture a screenshot from the provided simulator in Amazon Seller Central.

Cost Documentation: Occasionally, you might need to submit the “Fulfillment by Amazon Cost Report”.

As your trusted Customs Procedures Attorneys (ACP) in Japan, ACP JAPAN is committed to meticulously preparing all requisite documentation and screenshots for the import declaration process. Depend on our skilled guidance to meet all your customs requirements.

Our ACP Service: The Best Solution for the Japan Importer of Record (IOR) and Exporter of Record (EOR)

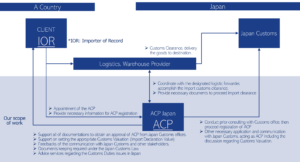

Attorney for Customs Procedures (ACP) is the best solution for addressing the issue of Japan IOR – Importer of Record. Below is an outline of our primary services and a diagram illustrating the operational structure of the ACP service. Upon successful ACP registration, a foreign entity can become the Japan IOR – Importer of Record.

Basic Scope of Services:

- Consultation with the Japan Customs Office for successful ACP registration.

- Liaising with stakeholders, including Logistics Forwarding Companies and the Customs Offices, on behalf of non-resident clients (i.e., non-resident Japan IOR) to ensure the secure importation of goods.

- Assistance in preparing the necessary documentation for import clearance.

- Support of calculation of Customs Value (Customs Valuation Formula), in accordance with appropriate compliance under the Japan Tariff Customs Law.

- Security Export Control (Classification for List Control, Examination for Catch-All Control, Application of the license to Ministry of Economy, Trade and Industry)

- Documents keeping, required under article 95 – Japan Customs Law

- Providing professional trade/customs advice if any issues arise.

**Both import and export activities can benefit from the use of an ACP (Attorney for Customs Procedures). This support is applicable in scenarios where a non-resident acts as the Importer of Record (IOR) for imports and as the Exporter of Record (EOR) for exports.

Three Steps to Initiate Shipments Under the ACP Program: :

- Quotation Review to Contract Conclusion: Upon receiving your contact details, we will promptly provide a quotation for your review.

- Commencing the Registration of ACP (Attorney for Customs Procedure) to Japan Customs: This process is generally completed in about two weeks.

- Initiation of First Shipment, Import/Export

Our Customers – Japan IOR / Attorney for Customs Procedures (ACP) Service

All our clients have successfully become Japan Importer of Record (IOR) and imported goods into Japan under our guidance.