Japan Qualified Invoice System and Compliance JCT (Japan Consumption Tax)

Recently, many companies have been registering as Qualified Invoice Issuers for Japanese Consumption Tax (JCT) due to the new invoice system introduced in October 2023. This new system is similar to the EU’s VAT invoice system.

After October 2023, your Japanese customer cannot claim input JCT credits unless the sellers (suppliers) issue a qualified invoice that includes a JCT registration number. To issue a qualified invoice, sellers (suppliers) need to be a taxable entity and obtain a JCT registration number.

Before October 2023:

Any customer (Company-B) who paid for goods or services could deduct input JCT regardless of whether the seller (Company-A) was registered for JCT. There was no requirement to verify the tax status of the seller.

After October 2023:

Any customer (Company-B) can only deduct input JCT if Company-A, the seller, is registered and can provide a qualified invoice with a JCT registration number. If Company-A cannot issue such an invoice, Company-B may choose not to continue purchases from them. If Company-A sells only to consumers and not businesses, it may not need to issue qualified invoices since consumers typically do not claim JCT tax returns.

Once Company-A obtains a JCT invoice registration number, it becomes a taxable entity required to file JCT returns regularly.

For non-resident entities (Company-A) importing and selling in Japan, the standard procedure involves three steps:

- Pay import JCT to customs: 10% of the import customs value.

- Collect JCT from customers in Japan: 10% of the sales price.

- File a JCT tax return and pay the net JCT to the tax office.

If Company-A paid the import JCT as the importer using an Attorney for Customs Procedures (ACP), they need only pay the net amount of sales JCT minus import JCT.

If Company-A paid the import JCT but was not the importer, they must pay all the collected sales JCT without deducting the import JCT.

Therefore, using an ACP to act as the Importer of Record (IOR) is crucial for managing JCT deductions and refunds. If another company acts as the IOR, you cannot deduct the import JCT, resulting in significant costs.

We strongly recommend using our ACP services to ensure you can act as the IOR, optimizing your JCT handling. Our team has extensive experience helping clients become importers and successfully manage their JCT responsibilities. You can rely on our expertise to navigate these complexities.

Our ACP Service: The Best Solution for the Japan Importer of Record (IOR) and Exporter of Record (EOR)

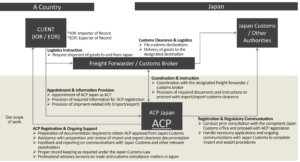

ACP is an effective solution for addressing Importer of Record (IOR) and Exporter of Record (EOR) requirements in Japan. Through our ACP service, non-resident entities located outside Japan are able to import and export goods as Non-Resident IOR and EOR.

Below is an overview of our basic scope of work, together with a diagram illustrating the operational structure of the ACP service. Once ACP registration is completed, the non-resident entity can act as the Importer of Record (IOR) and Exporter of Record (EOR) in Japan.

Scope of Work – How We Can Assist

- Consultation with Japan Customs to support successful ACP registration.

- Liaison with relevant stakeholders, including freight forwarders and Japan Customs, to ensure the smooth and compliant import and export of goods.

- Assistance in preparing and reviewing import and export clearance documentation.

- Support in the calculation of customs value, in accordance with the Japan Customs Tariff Act.

- Assistance with advance rulings on HS classification, customs valuation, and rules of origin.

- Import compliance support for regulated products, including Domestic Administrator (sometimes referred to as “Domestic Representative”) Services under the Product Safety Acts (PSE/PSC) and food-related products regulated under the Food Sanitation Act.

- Support for security export control, including list-based classification, catch-all control assessment, and assistance with export license applications to the Ministry of Economy, Trade and Industry (METI).

- Record-keeping support in accordance with Article 95 of the Japan Customs Law.

- Provision of professional trade and customs advisory services to address and resolve issues that may arise during import or export operations.

**Both import and export activities can benefit from the use of an ACP (Attorney for Customs Procedures). This support is applicable in scenarios where a non-resident acts as the Importer of Record (IOR) for imports and as the Exporter of Record (EOR) for exports.

Three Steps to Initiate Shipments Under the ACP Program:

- Quotation Review to Contract Conclusion: Upon receiving your contact details, we will promptly provide a quotation for your review.

- Commencing the Registration of ACP (Attorney for Customs Procedures) to Japan Customs: This process is generally completed in about two weeks.

- Initiation of First Shipment, Import/Export

Our Japan Consumption Tax (JCT) Representative Services

At ACP Japan, we provide a comprehensive one-stop service that covers both customs procedures through the Attorney for Customs Procedures (ACP) and Japan Consumption Tax (JCT) procedures with the National Tax Agency through a designated JCT Tax Representative.

By working closely with our trusted partner tax accountants, we act as your ACP while maintaining close coordination and information sharing with the tax representative. This collaboration ensures the proper deduction and refund of Japan Consumption Tax paid at the time of importation.

Track Record – Attorney for Customs Procedures (ACP) Services

We have supported import and export operations in Japan for over 200 clients across more than 40 countries.

Examples of International Logistics Partners We Have Worked With

We have a proven track record of working with a wide range of logistics providers. As the Attorney for Customs Procedures (ACP), we handle customs-related responsibilities while logistics companies manage transportation and warehousing operations.

- Apex International

- Brink’s

- CEVA Logistics

- Coshipper

- Crane Worldwide Logistics

- DB Schenker

- DGX (Dependable Global Express)

- DHL Express

- DHL Global Forwarding

- Dimerco

- DSV Air & Sea

- Expeditors

- FedEx Express

- FERCAM

- GOTO KAISOTEN Ltd.

- Harumigumi

- Herport

- ICL Logistics

- JAS Forwarding

- Kintetsu Express

- Kokusai Express

- Kuehne + Nagel

- Mitsubishi Logistics

- MOL Logistics

- Nankai Express

- Nippon Express

- OIA Global

- PGS

- Rhenus Group

- Röhlig

- Sankyu

- Sanyo Logistics

- Scan Global Logistics

- Seino Schenker

- SEKO Logistics

- Shin-Ei gumi

- Shiproad

- Sumitomo Warehouse

- UPS

- UPS Supply Chain Solutions

- Yamato Transport

…and many other logistics providers in Japan and around the world.