Export to Japan Using ACP – No Local Office Needed

Rethinking Global Supply Chains in Uncertain Times

Trade uncertainty is nothing new—but since the rise of protectionist policies in major economies like the U.S. and China, the landscape has changed significantly. Tariffs have become a real business cost, and exporting into these markets has become more expensive and complicated. That’s why many global companies are now rebuilding their supply chains, reassessing where and how they move their products—and seeking markets that offer stability and predictability.

Why Japan Makes Sense – Right Now

Here’s the good news: Japan offers one of the most stable and welcoming environments for global trade. With low average tariff rates and a wide network of Economic Partnership Agreements (EPAs), Japan allows many imported products to qualify for reduced or zero tariffs. What’s more, unlike many countries shifting toward protectionism, Japan remains open to foreign trade and investment, both politically and economically. Combine that with strong consumer demand and a large population, and you’ve got a market that’s not just stable—but genuinely strategic.

No Office in Japan? No Problem.

Even if your company doesn’t have a presence in Japan, you can still enter the market. By appointing us ACP JAPAN as your Attorney for Customs Procedures (ACP), you can act as your own Importer of Record (IOR) or Exporter of Record (EOR)—giving you full control over your operations in Japan.

Real-World Solutions for Global Sellers

Many of our clients are already selling in Japan using cross-border e-commerce platforms like Amazon Japan, Rakuten, Shopify, or through third-party logistics (3PL) providers. They hold inventory in Japan and manage orders remotely—without setting up a local office or entity. Japan’s infrastructure and business environment make this model simple and scalable.

How We Help

We, ACP JAPAN, guide international businesses through every step of entering the Japanese market. With extensive experience and strong networks of customs experts, logistics partners, and tax professionals, we provide end-to-end support—from import setup to daily operations.

Ready to Expand into Japan?

Let’s talk. If you’re considering Japan as your next market, we’d love to help you make it happen—smoothly, efficiently, and fully compliant.

Track Record – Attorney for Customs Procedures (ACP) Services

We have supported import and export operations in Japan for over 200 clients across more than 40 countries.

What is ACP? – Attorney for Customs Procedure

In principle, Japan Customs does not permit a foreign entity to act as the Importer of Record (*IOR). But the foreign entity can act as a non-resident importer (IOR – Importer of Record) if you appoint an ACP (Attorney for Customs Procedure) who can handle the customs procedure on your behalf.

We, ACP Japan provide this service as being ACP. On behalf of non-resident clients, we support by ensuring the import customs procedure.

We support many import projects including E-commerce such as Amazon’s FBA (Fulfillment By Amazon) program and Rakuten for the international sellers.

Please feel free to contact us!

Our ACP Service: The Best Solution for the Japan Importer of Record (IOR) and Exporter of Record (EOR)

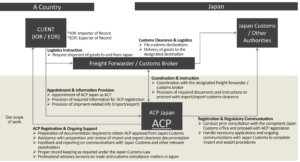

ACP is an effective solution for addressing Importer of Record (IOR) and Exporter of Record (EOR) requirements in Japan. Through our ACP service, non-resident entities located outside Japan are able to import and export goods as Non-Resident IOR and EOR.

Below is an overview of our basic scope of work, together with a diagram illustrating the operational structure of the ACP service. Once ACP registration is completed, the non-resident entity can act as the Importer of Record (IOR) and Exporter of Record (EOR) in Japan.

Scope of Work – How We Can Assist

- Consultation with Japan Customs to support successful ACP registration.

- Liaison with relevant stakeholders, including freight forwarders and Japan Customs, to ensure the smooth and compliant import and export of goods.

- Assistance in preparing and reviewing import and export clearance documentation.

- Support in the calculation of customs value, in accordance with the Japan Customs Tariff Act.

- Assistance with advance rulings on HS classification, customs valuation, and rules of origin.

- Import compliance support for regulated products, including Domestic Administrator (sometimes referred to as “Domestic Representative”) Services under the Product Safety Acts (PSE/PSC) and food-related products regulated under the Food Sanitation Act.

- Support for security export control, including list-based classification, catch-all control assessment, and assistance with export license applications to the Ministry of Economy, Trade and Industry (METI).

- Record-keeping support in accordance with Article 95 of the Japan Customs Law.

- Provision of professional trade and customs advisory services to address and resolve issues that may arise during import or export operations.

**Both import and export activities can benefit from the use of an ACP (Attorney for Customs Procedures). This support is applicable in scenarios where a non-resident acts as the Importer of Record (IOR) for imports and as the Exporter of Record (EOR) for exports.

Three Steps to Initiate Shipments Under the ACP Program: :

- Quotation Review to Contract Conclusion: Upon receiving your contact details, we will promptly provide a quotation for your review.

- Commencing the Registration of ACP (Attorney for Customs Procedure) to Japan Customs: This process is generally completed in about two weeks.

- Initiation of First Shipment, Import/Export