The Import Permit Document holds significant importance in import clearance procedures. It serves as evidence for the deduction of Japan Consumption Tax (JCT). When filing periodic JCT returns, this document is necessary to claim deductions or refunds for the amount paid during import. It is crucial to ensure that the Import Permit accurately reflects the information of the Importer of Record (IOR) as it directly impacts the eligibility for JCT deduction.

Non-resident entities utilizing the services of an Attorney for Customs Procedures (ACP) will have their names clearly stated on the Import Permit as IOR, allowing them to successfully claim JCT deductions.

Import Permit Document Sample

Upon completion of import clearance procedures, Japan Customs issues an Import Permit document.

Please refer to the sample Import Permit document below:

Japan Consumption Tax (JCT) is set at a fixed rate of 10%. On the other hand, the tariff rate for Customs Duty varies depending on the HS Code assigned to the imported goods. To verify the applicable tariff rate, you can refer to the Japan Customs Tariff Schedule on their official website here: Japan Customs Tariff Schedule

Alert: Importer (IOR) Service Provider May Not Be in Compliance with Customs Laws

Attention must be given to cases where IOR service providers or forwarders act as the IOR but mask or omit their information on the Import Permit Document. This raises concerns about their compliance with Japan Customs Law, such as Customs Valuation. It is important to be cautious when encountering such situations as they may indicate underlying issues.

Importers are responsible for paying penalties, such as additional taxes or penalties, when there is a shortfall in the tax amount owed. It is the importer’s obligation to fulfill their tax payment requirements. However, it should be noted that IOR service providers may not be cooperative in the event of a customs post clearance audit.

Unfortunately, we actually observe that some non-resident entities suffer from the fact that the 10% import consumption tax is not deductible (or refundable), and they were penalized by the customs post clearance audit. In the end, they decided to use ACP, not IOR service provider.

While not all IOR service providers are non-compliant, it is observed that certain providers engage in inappropriate practices. Opting for these providers based on cost-saving measures may result in the inability to deduct or refund 10% JCT, leading to hidden costs and detrimental business outcomes.

As a reputable Customs professional, ACP Japan strictly adheres to Japan Customs Law and confidently provides clients with the Import Permit Document. We are listed as the ACP, while clients are appropriately identified as the IOR on the document.

Benefits of Using ACP

For non-resident entities, choosing ACP is strongly recommended. We ensure full compliance with the Japan Customs Law and offer the best solution for correct JCT deduction/refund.

Japanese Customs System Reform: Clarification of Importer Definitions

Starting October 1, 2023, Japanese Customs has instituted a pivotal reform aimed at addressing the issue of foreign sellers improperly designating third parties (such as forwarders or customs agents) as importers.

This revision necessitates foreign corporations to utilize an Attorney for Customs Procedures (ACP) to assume the role of Importer of Record (IOR) directly in many cases. The practice of merely nominally appointing another entity as the importer is no longer feasible.

Notably, foreign corporations that act as importers themselves, through the engagement of ACP, are eligible for Japan Consumption Tax (JCT) benefits.

As a dedicated ACP firm, we ensure compliance with the law to facilitate correct import procedures, allowing you to trust us with your importation requirements confidently. We are eager to engage in further discussions with you.

Why choose us?

We specialize in navigating complex issues at the intersection of customs procedures and taxation—an area where our ability to offer practical, comprehensive support from both perspectives sets us apart. Understanding the close relationship between customs duties and national taxes (especially, Japan Consumption Tax – JCT), and addressing both in an integrated manner, is crucial in the context of international trade.

- Customs and International Trade Professionals – Led by our CEO, Mr. Sawada—Certified Customs Specialist and former KPMG professional—ACP Japan provides expert-level support in Customs and international trade. Mr. Sawada also serves as an external expert for the World Bank’s B-READY project in the field of customs and international trade.

- Full Compliance with Japanese Customs Law – We ensure full adherence to Japanese Customs Law, including Importer of Record (IOR) structure, HS code classification, and customs valuation. We assist in preparing all essential shipping documents for non-resident entities.

- One-Stop Support for ACP and JCT Tax Representative Services – In collaboration with trusted partner tax accountants, we provide comprehensive support for both customs procedures through the Attorney for Customs Procedures (ACP) and Japan Consumption Tax (JCT) filings through the JCT Tax Representative.

- Multilingual Communication – Our team communicates fluently in English, Japanese, and Chinese, offering smooth coordination with global clients and authorities in Japan.

- Support for Regulated Products – Our ACP/IOR partnership system can manage regulated items, including cosmetics, PSE-products, foodstuffs, and tableware.

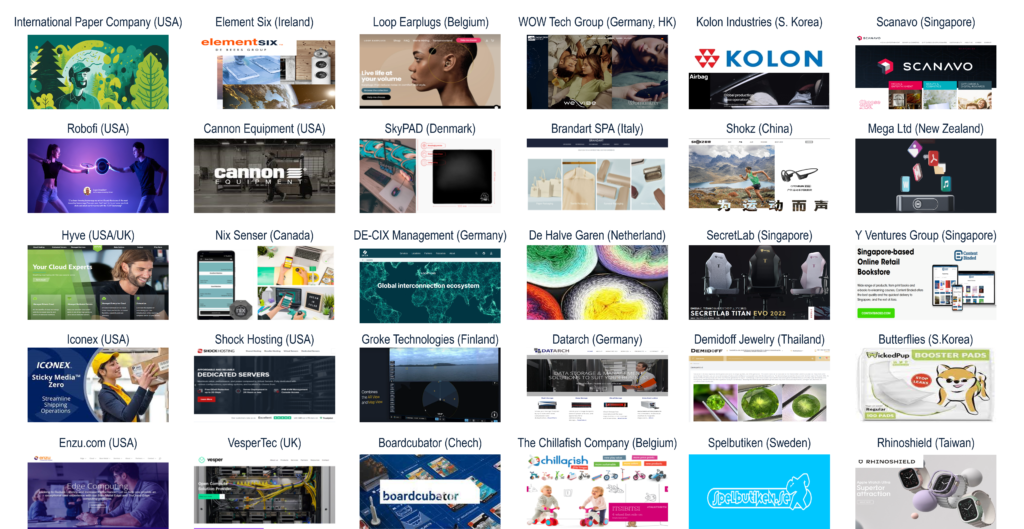

- Trusted by Global Clients – Serving around 100 ACP clients annually, including many Amazon sellers, we’re a certified provider on Amazon SPN (Service Provider Network) under Trade Compliance.

Track Record – Attorney for Customs Procedures (ACP) Services

We have supported import and export operations in Japan for over 200 clients across more than 40 countries.

Examples of International Logistics Partners We Have Worked With

We have a proven track record of working with a wide range of logistics providers. As the Attorney for Customs Procedures (ACP), we handle customs-related responsibilities while logistics companies manage transportation and warehousing operations.

- American Overseas Transport (AOT)

- Apex International

- Brink’s

- CEVA Logistics

- Coshipper

- Crane Worldwide Logistics

- DB Schenker

- DGX (Dependable Global Express)

- DHL Express

- DHL Global Forwarding

- Dimerco

- DSV Air & Sea

- Expeditors

- FedEx Express

- FERCAM

- GOTO KAISOTEN Ltd.

- Harumigumi

- Herport

- ICL Logistics

- JAS Forwarding

- Kintetsu Express

- Kokusai Express

- Kuehne + Nagel

- Mitsubishi Logistics

- MOL Logistics

- Nankai Express

- Nippon Express

- OIA Global

- PGS

- Rhenus Group

- Röhlig

- Sankyu

- Sanyo Logistics

- Scan Global Logistics

- Seino Schenker

- SEKO Logistics

- Shibusawa Logistics Corporation

- Shin-Ei gumi

- Shiproad

- Sumitomo Warehouse

- UPS

- UPS Supply Chain Solutions

- Yamato Transport

…and many other logistics providers in Japan and around the world.

Our ACP Service: The Best Solution for the Japan Importer of Record (IOR) and Exporter of Record (EOR)

ACP is an effective solution for addressing Importer of Record (IOR) and Exporter of Record (EOR) requirements in Japan. Through our ACP service, non-resident entities located outside Japan are able to import and export goods as Non-Resident IOR and EOR.

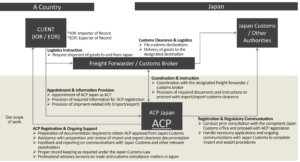

Below is an overview of our basic scope of work, together with a diagram illustrating the operational structure of the ACP service. Once ACP registration is completed, the non-resident entity can act as the Importer of Record (IOR) and Exporter of Record (EOR) in Japan.

Scope of Work – How We Can Assist

- Consultation with Japan Customs to support successful ACP registration.

- Liaison with relevant stakeholders, including freight forwarders and Japan Customs, to ensure the smooth and compliant import and export of goods.

- Assistance in preparing and reviewing import and export clearance documentation.

- Support in the calculation of customs value, in accordance with the Japan Customs Tariff Act.

- Assistance with advance rulings on HS classification, customs valuation, and rules of origin.

- Import compliance support for regulated products, including Domestic Administrator (sometimes referred to as “Domestic Representative”) Services under the Product Safety Acts (PSE/PSC) and food-related products regulated under the Food Sanitation Act.

- Support for security export control, including list-based classification, catch-all control assessment, and assistance with export license applications to the Ministry of Economy, Trade and Industry (METI).

- Record-keeping support in accordance with Article 95 of the Japan Customs Law.

- Provision of professional trade and customs advisory services to address and resolve issues that may arise during import or export operations.

**Both import and export activities can benefit from the use of an ACP (Attorney for Customs Procedures). This support is applicable in scenarios where a non-resident acts as the Importer of Record (IOR) for imports and as the Exporter of Record (EOR) for exports.

Three Steps to Initiate Shipments Under the ACP Program:

- Quotation Review to Contract Conclusion: Upon receiving your contact details, we will promptly provide a quotation for your review.

- Commencing the Registration of ACP (Attorney for Customs Procedures) to Japan Customs: This process is generally completed in about two weeks.

- Initiation of First Shipment, Import/Export