Consumption tax in Japan applies to the transfer of assets conducted domestically by businesses, which means that non-residents and foreign corporations are also subject to consumption tax and are obliged to pay it if they transfer assets within Japan.

In some cases, such as exempt businesses, it may not be necessary to pay the tax to the national tax office.

However, the following are examples where one cannot qualify as an exempt business and must file for consumption tax:

Examples where JCT tax filing is required:

- Qualified JCT Invoice Issuers

- Businesses with taxable sales exceeding JPY 10 million in the base period (roughly speaking, the fiscal year two years prior) for the taxable period

- Businesses with taxable sales exceeding JPY 10 million for the specified period (roughly speaking, the first six months of the previous fiscal year, etc.)

- New corporations (including specified newly established corporations) with capital or investment of JPY 10 million or more for taxable periods without a base period

- Businesses that have made the election to become a taxable enterprise

※ With the amendments to the Consumption Tax Law in April 2024, regarding point 4, if a foreign corporation has capital or contributions exceeding 10 million yen when they start business operations in Japan (including specified newly established corporations), regardless of when the corporation was established abroad, they are obliged to pay taxes and declare from the fiscal year they start operations in Japan (applicable for taxable periods starting after October 1, 2024).

We specialize in navigating complex issues at the intersection of customs procedures and taxation—an area where our ability to offer practical, comprehensive support from both perspectives sets us apart. Understanding the close relationship between customs duties and national taxes (especially, Japan Consumption Tax – JCT), and addressing both in an integrated manner, is crucial in the context of international trade.

What Is a JCT Tax Representative and Why Is It Required?

When a non-resident foreign entity becomes subject to Japan’s Consumption Tax (JCT), it is required to appoint a JCT Tax Representative (Tax Agent).

If a non-resident company sells goods to customers in Japan, it typically collects 10% consumption tax on those sales. This collected JCT must be reported and submitted to the Japanese National Tax Office, unless the entity qualifies as a tax-exempt business. (See: “Are we a Tax-Exempt Business?”)

If the entity is JCT-liable—or voluntarily registers as a taxable entity, such as by obtaining a Qualified Invoice Issuer Number—it must appoint a JCT Tax Representative to handle all tax-related procedures in Japan, including JCT tax filings.

In the JCT tax return process, the paid import JCT can be offset against the collected JCT.

- If the import JCT exceeds the collected amount, the difference may be refunded.

- If the collected JCT exceeds the import amount, the difference must be paid to the tax office.

A JCT Tax Representative is legally required to manage this process on behalf of the foreign entity.

Please note:

The JCT Tax Representative is distinct from the Attorney for Customs Procedures (ACP), which is appointed for customs clearance purposes.

- ACP = Customs representative

- JCT Tax Representative = Tax representative

Our Japan Consumption Tax (JCT) Representative Services

At ACP Japan, we provide a comprehensive one-stop service that covers both customs procedures through the Attorney for Customs Procedures (ACP) and Japan Consumption Tax (JCT) procedures with the National Tax Agency through a designated JCT Tax Representative.

By working closely with our trusted partner tax accountants, we act as your ACP while maintaining close coordination.

JCT Compliance

Understanding the handling of JCT (such as payment of import JCT, collection of sales JCT from customers, and JCT returns) is crucial to avoid significant cost burdens. This is a vital aspect, so please ensure a thorough understanding to determine the most optimal business model.

Basic procedure

For non-resident entities (Company-A) that import and sell goods to customers in Japan, the standard procedure involves three steps:

- Pay import Japan Consumption Tax (JCT) to a customs office, 10% of the import customs value when Company-A imports goods. <PAY TO CUSTOMS OFFICE>

- Obtain JCT from customers in Japan, 10% of the sales price when Company-A sells goods.

- Submit JCT tax return and pay the difference amount (2) – (1) to a tax office periodically <PAY TO TAX OFFICE (different authority from Customs Office)>

Note: Using ACP to become the importer (IOR) is essential for JCT deductions and refunds. If another company acts as the IOR, you cannot deduct the input tax (step 1), and must pay the entire VAT collected (step 2) to the national tax authorities, leading to significant costs.

If you are a JCT-exempt business, the process ends at steps 1 and 2. For taxable businesses or invoice-registered businesses, step 3 (Final Tax Return) is obligatory.

In the Final Tax Return (step 3), if the JCT paid (step 1) exceeds the provisional JCT received (step 2), the difference is refunded. Conversely, if the provisional JCT received (step 2) exceeds the JCT paid (step 1), the difference must be paid to the tax office.

Why IMPORTER is important?

It is crucial to note that only the IMPORTER can deduct the import consumption tax at the time of tax filing. (= Deduct above (1) from (2) )

If Company-A uses another company to act IMPORTER, then Company-A can’t do above (3). Company-A has to pay all the amount of (2) to a tax office.

However, if Company-A imports goods using the Attorney for Customs Procedure (ACP), it becomes the Importer and can deduct the import consumption tax when filing the JCT tax return. In this case, Company-A only needs to pay the difference between the JCT collected from customers and the import JCT (2) – (1) paid to the Tax Office.

Appoint a tax accounting firm as Tax Representative / Tax Agent

Apart from utilizing ACP, when filing taxes in Japan (3), Company-A must appoint a Tax Representative. The Tax Representative will handle JCT tax registration and JCT filings with the tax office on behalf of the non-resident entity. ACP Japan can introduce our partner tax accounting company that can act as the Tax Representative.

Are we a Tax-Exempt Business?

Tax Filing Obligations of Nonresidents and Foreign Corporations

First, the consumption tax received from customers in Step 2 above should basically be paid to the national tax office. Consumption tax is imposed on transfers, etc. of assets made in Japan. Therefore, even if a nonresident or foreign corporation transfers assets in Japan, it is subject to consumption tax and is obligated to pay the tax.

In some cases, such as exempt businesses, it may not be necessary to pay the tax to the national tax office.

However, the following are examples where one cannot qualify as an exempt business and must file for consumption tax:

Examples of Entities Required to File JCT Tax Returns (Non-Exempt Businesses)

- Qualified Invoice Issuers:

Businesses registered as qualified invoice issuers under Japan’s invoice system.

- Businesses with Taxable Sales Exceeding JPY 10 Million During the Base Period:

Entities whose taxable sales in Japan during the base period (generally the fiscal year two years prior) exceed JPY 10 million.

- Businesses with Taxable Sales Exceeding JPY 10 Million During the Specific Period:

Entities whose taxable sales in Japan during the specific period (generally the first six months of the previous fiscal year) exceed JPY 10 million.

- Newly Established Corporations with Capital of JPY 10 Million or More:

Newly established corporations (including certain newly established corporations) with capital or investment of JPY 10 million or more during a taxable period without a base period.

- Foreign Corporations with Capital of JPY 10 Million or More Deemed to Have No Base Period: (Applicable to taxable periods starting on or after October 1, 2024) *

Foreign corporations without a base period and with capital or investment of JPY 10 million or more at the start of the fiscal year are not exempt from consumption tax obligations.

- Businesses Opting for Taxable Enterprise Status:

Entities that voluntarily select to be treated as taxable enterprises.

Disclaimer: The above outlines the general principles of Japan’s consumption tax obligations. Each company’s specific tax liability should be confirmed by consulting with a licensed tax accountant.

If you’re an Exempted entity

During the exempt term, a new entity is not required to file tax returns. As long as your entity has exempt status, you are only required to:

(1) Pay 10% tax of the import customs value when you import goods.

(2) Collect 10% of the sales price when you sell goods.

That’s all. You can enjoy the difference (2) – (1).

Can Tax-Exempt Businesses Receive Refunds?

Yes, however, a final JCT tax return (Step 3) is required in order to receive a refund. Even if your business is initially classified as tax-exempt, you may voluntarily register as a taxable entity and begin filing JCT tax returns to claim refunds for import JCT you have paid.

This can be beneficial, for example, when the JCT paid at import (Step 1) exceeds the JCT collected from customers (Step 2). In such cases, the difference may be refunded by the National Tax Office.

Importantly, to claim a refund or deduction for import JCT, the use of an Attorney for Customs Procedures (ACP) is essential for non-resident businesses—only ACP-registered importers are eligible for JCT recovery.

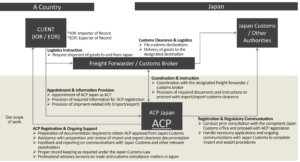

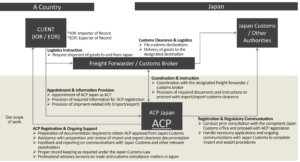

Our ACP Service: The Best Solution for the Japan Importer of Record (IOR) and Exporter of Record (EOR)

ACP is an effective solution for addressing Importer of Record (IOR) and Exporter of Record (EOR) requirements in Japan. Through our ACP service, non-resident entities located outside Japan are able to import and export goods as Non-Resident IOR and EOR.

Below is an overview of our basic scope of work, together with a diagram illustrating the operational structure of the ACP service. Once ACP registration is completed, the non-resident entity can act as the Importer of Record (IOR) and Exporter of Record (EOR) in Japan.

Scope of Work – How We Can Assist

- Consultation with Japan Customs to support successful ACP registration.

- Liaison with relevant stakeholders, including freight forwarders and Japan Customs, to ensure the smooth and compliant import and export of goods.

- Assistance in preparing and reviewing import and export clearance documentation.

- Support in the calculation of customs value, in accordance with the Japan Customs Tariff Act.

- Assistance with advance rulings on HS classification, customs valuation, and rules of origin.

- Import compliance support for regulated products, including Domestic Administrator (sometimes referred to as “Domestic Representative”) Services under the Product Safety Acts (PSE/PSC) and food-related products regulated under the Food Sanitation Act.

- Support for security export control, including list-based classification, catch-all control assessment, and assistance with export license applications to the Ministry of Economy, Trade and Industry (METI).

- Record-keeping support in accordance with Article 95 of the Japan Customs Law.

- Provision of professional trade and customs advisory services to address and resolve issues that may arise during import or export operations.

**Both import and export activities can benefit from the use of an ACP (Attorney for Customs Procedures). This support is applicable in scenarios where a non-resident acts as the Importer of Record (IOR) for imports and as the Exporter of Record (EOR) for exports.

Three Steps to Initiate Shipments Under the ACP Program:

- Quotation Review to Contract Conclusion: Upon receiving your contact details, we will promptly provide a quotation for your review.

- Commencing the Registration of ACP (Attorney for Customs Procedures) to Japan Customs: This process is generally completed in about two weeks.

- Initiation of First Shipment, Import/Export

Track Record – Attorney for Customs Procedures (ACP) Services

We have supported import and export operations in Japan for over 200 clients across more than 40 countries.

Examples of International Logistics Partners We Have Worked With

We have a proven track record of working with a wide range of logistics providers. As the Attorney for Customs Procedures (ACP), we handle customs-related responsibilities while logistics companies manage transportation and warehousing operations.

- Apex International

- Brink’s

- CEVA Logistics

- Coshipper

- Crane Worldwide Logistics

- DB Schenker

- DGX (Dependable Global Express)

- DHL Express

- DHL Global Forwarding

- Dimerco

- DSV Air & Sea

- Expeditors

- FedEx Express

- FERCAM

- GOTO KAISOTEN Ltd.

- Harumigumi

- Herport

- ICL Logistics

- JAS Forwarding

- Kintetsu Express

- Kokusai Express

- Kuehne + Nagel

- Mitsubishi Logistics

- MOL Logistics

- Nankai Express

- Nippon Express

- OIA Global

- PGS

- Rhenus Group

- Röhlig

- Sankyu

- Sanyo Logistics

- Scan Global Logistics

- Seino Schenker

- SEKO Logistics

- Shin-Ei gumi

- Shiproad

- Sumitomo Warehouse

- UPS

- UPS Supply Chain Solutions

- Yamato Transport

…and many other logistics providers in Japan and around the world.