Imported goods into Japan can receive reductions, exemptions, or refunds of customs duties and import tax (Japan Consumption Tax) under certain conditions specified by the Customs Tariff Law and other relevant procedures. The customs duty relief and refund system is divided into two main categories: permanent schemes established under the Customs Tariff Law and temporary measures outlined in the Temporary Tariff Measures Law. Here is a summary of each system:

Customs Tariff Law – Permanent Program

Reduction for deterioration and damage (Art.10)

For imported goods that have suffered deterioration or damage in the bonded area after the import declaration, it is unreasonable to impose a duty equal to that of goods which have not been affected. Therefore, to address this discrepancy, the duty amount on the deteriorated or damaged goods may be reduced or refunded.

Reduction for goods exported for processing or repair (Art.11)

For goods exported from Japan for processing (only if the processing is recognized as difficult to perform in Japan) or for repair, and then re-imported into Japan within one year from the date of their export permit, a duty reduction equivalent to the duty on goods of the same nature and form at the time of export permission may be applied.

To qualify for duty reduction or exemption upon re-importation after processing or repair, in addition to the usual export procedures, the export declaration must specify that the goods are exported for repair, the anticipated time of import, and the planned place of import. Two copies of the “Processed/Repaired Goods Verification Declaration Form” must be submitted (Customs Form T No. 1050 for duty reduction and Customs Form P No. 7720 for exemption), one of which will be returned to the applicant after customs verification. Additionally, a “Repair Contract” or, if no contract is available, a document of correspondence related to the repair with the foreign exporter or manufacturer must be submitted for customs verification, after which it will be returned to the applicant.

Reduction and exemption for basic goods such as pork and sugar (Art. 12)

Duties on certain goods may be reduced or exempted in cases where the prices of imported essentials have surged. This measure aims to prevent price increases of daily necessities, including food and clothing, thereby helping to maintain stability in people’s everyday lives.

Reduction and exemption for raw materials used in manufacturing (Art. 13)

Duties on imported raw materials such as corn may be reduced or exempted to support the development of domestic industries that manufacture specific products like formula feed. This measure also aims to maintain stability in people’s everyday lives by ensuring the affordability and availability of essential manufacturing inputs.

Unconditional Exemption (Art. 14)

Duties may be exempted for the following items: 1) articles for the use of the Imperial House, 2) articles belonging to the head of a foreign country, 3) articles under state monopoly, and 4) re-imported articles.

Reduction and Exemption for Re-importation (Art. 14-2)

For goods re-imported without any change in quality and shape after exportation, if the amount of customs duty chargeable upon re-importation exceeds the duty previously not levied or reduced, an exemption or reduction is applied. The duty shall be reduced by an amount equal to the difference between the duty previously chargeable and the new duty amount under the following conditions:

- For products carried out under bonded hozei work (bonded area), the amount of customs duty not actually levied under hozei work;

- For products that had previously received a reduction, exemption, refund, or deduction, the amount of customs duty reduction, exemption, or refund newly chargeable upon said product.

Exemption for special use (Art. 15)

The duty of special goods (articles used for scientific research or education, etc.) may be exempted conditionally in terms of promotion of science in Japan.

Exemption for Goods for Diplomats (Art. 16)

Duties on articles for the official use of foreign embassies and personal use items imported by foreign ambassadors may be exempted. This exemption is granted based on traditional international customs and obligations under international laws.

Exemption for Re-exportation (Art. 17)

To promote processing trade and advance cultural and academic levels, duties on goods that do not impact domestic industries and are not consumed in Japan may be exempted. This exemption applies when such goods are re-exported within a year from the date of the import permit.

1. Eligible Goods:

The following goods, if imported and re-exported within one year from the date of import permit, are eligible for customs duty exemption:

- Goods processed or to be used as processing materials

- Containers for imported or exported goods

- Goods to be repaired

- Academic research supplies

- Test samples

- Testing equipment for imported/exported goods

- Samples for orders collection or manufacturing

- Goods used in international sports competitions and conferences

- Items for touring performances and film shooting equipment

- Goods displayed at expositions, exhibitions, fairs, and review events

- Vehicles imported temporarily by travelers or shipped separately

- Goods re-exported under the provisions of treaties and exempt from taxes

2. Procedures:

(1) Import Procedures:

(2) Export Procedures:

Note: If the imported goods are not re-exported within one year, or are used for other purposes, the exempted duties must be paid. It is necessary to notify the customs in advance and proceed with the required procedures.

Reduction for Re-exportation (Art. 18)

For goods that are durable and imported to Japan temporarily, typically under a lease contract, and are subsequently re-exported, the duty chargeable upon re-exportation (excluding the value of usage while in Japan) may be reduced. This facilitates the temporary use of such goods without imposing the full burden of duties as if they were permanently imported.

Reduction and Exemption on Raw Materials for Production of Export Goods (Art. 19)

Duties on raw materials used in the production of special export goods may be reduced, exempted, or refunded. This measure is intended to enhance the global competitiveness of these goods and promote exports by alleviating the tax burden on essential production components.

Refund and Exemption for Exportation of Goods Manufactured from Duty-Paid Raw Materials (Art. 19-2)

In situations where foreign raw materials, equivalent to domestic types, are necessarily used in the manufacturing of products at a bonded manufacturing warehouse, the duty paid on such raw materials may be exempted or refunded. This provision is designed to support manufacturing processes that contribute to export activities by alleviating the duty burden on essential imported raw materials.

Refund on Export of Goods Whose Nature and Form Are Unchanged Since Importation (Art. 19-3)

When goods that have been imported and on which customs duty has been paid are re-exported from Japan without any changes in their nature and form since their importation, the customs duty paid on these goods may be refunded. This refund must be claimed within one year from the date of their import permit. This provision aims to facilitate international trade by allowing the return of duties on goods that were not utilized or altered within Japan.

To receive a refund of customs duties at the time of re-exportation, apart from following the usual import procedures, you must submit two copies of the “Re-export Goods Verification Application Form” (Customs Form T-1625) to customs. One copy will be returned to the applicant after customs verification.

When re-exporting, in addition to the standard export procedures, you need to submit the previously obtained import permit and two copies of the “Application for Refund (Reduction) of Customs Duty for Goods Re-exported in the Same Condition as Imported” (Customs Form T-1627), along with the “Re-export Goods Verification Application Form” that was verified upon import.

The identity of the goods being imported and re-exported is confirmed through marks, numbers, or details on related documents such as packing lists, although sometimes additional documentation such as photographs or catalogs may be requested.

Please note that the entire process related to the refund of duties can be time-consuming. If you are considering applying for a duty refund, it is advisable to consult with customs in advance to understand the procedures and timelines.

Refund for Claimed Merchandise (Art. 20)

In cases where claimed merchandise is either re-exported or destroyed, the customs duty paid on such merchandise may be refunded. This provision is designed to assist importers who do not derive any economic benefit from these goods, ensuring they are not financially penalized for merchandise that does not serve its intended market purpose.

To receive a refund for customs duties for re-exported goods, it is essential to complete specific procedures at customs before exporting the goods. Failure to follow these procedures will result in ineligibility for the refund.

Eligible Goods:

- Goods that must be returned or disposed of due to differences from the contract terms in quality or quantity.

- Personal items sold through mail order that, upon import, do not meet the importer’s expectations in terms of quality, thus necessitating their return or disposal.

- Goods that, after importation, become subject to prohibitions on sale or use by law, necessitating their export or destruction in place of export.

Procedures:

To apply for this duty refund, it is mandatory to carry out the following steps at customs before exporting the goods:

If seeking a refund through re-export of non-compliant goods, the goods must first be moved into a bonded area and a “Non-compliant Goods Bonded Area Entry Notice” (Customs Form T No. 1630) must be submitted. Upon confirmation of entry, a receipt for this notice will be issued.

The export declaration for non-compliant goods involves the usual export procedures, plus submitting two copies of the “Customs Duty Refund (Reduction/Deduction) Application for Export of Non-compliant Goods” (Customs Form T No. 1640) with the following documents:

- Documents proving the non-compliance of goods.

- For personal items sold via mail order, documents proving such sale (catalogs, order forms, delivery notes, etc.)

- Proof that the sale or use of the goods or products made from them was banned after importation (copies of the relevant laws or public notices published).

- Import permit or a substitute certificate from customs.

- Receipt for the “Non-compliant Goods Bonded Area Entry Notice.”

If seeking a refund through destruction of non-compliant goods, similar steps as above are required for the goods’ entry into a bonded area and receiving the entry receipt, followed by submitting two copies of the “Destruction Approval Application” (Customs Form C No. 3170) with all the aforementioned documents, and obtaining approval for the destruction.

Subsequently, apply for the customs duty refund (reduction/deduction) for the destroyed non-compliant goods by submitting one copy of the “Customs Duty Refund Application for Destroyed Non-compliant Goods” (Customs Form T No. 1660) with the attached destruction approval.

Note: As these refund procedures can be time-consuming, it is advised to consult with customs in advance if you are considering applying for a refund.

Temporary Tariff Measures Law

Exemption for Aircraft Parts (Art. 4)

Customs duties on aircraft parts that are difficult to manufacture in Japan may be exempted. This exemption is justified by the role such parts play in advancing aircraft transportation, manufacturing, space development, and related technologies, which contribute significantly to the development of industrial economies.

Reduction for Products Manufactured from Exported Goods (Art. 8)

Specific import goods made from items that were exported from Japan for processing or assembling, and returned to Japan within one year from the date of export, may qualify for a reduced customs duty. This reduction supports the re-importation of processed or assembled goods, fostering a cycle of export and re-import for added value.

Exemption for Goods Exported for Processing or Repair under Economic Partnership Agreement (Art. 8-7)

Goods exported from Japan to countries that are parties to an Economic Partnership Agreement for processing or repair, and returned within one year, may have their customs duties exempted. This exemption is designed to facilitate the international flow of goods for enhancement and repair, promoting economic partnerships and technological exchanges.

These provisions reflect Japan’s strategic measures to support key industrial sectors, encourage international trade relations, and leverage global partnerships for technological advancement.

Japan Customs:

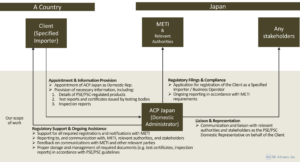

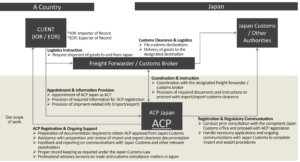

Track Record – Attorney for Customs Procedures (ACP) Services

We have supported import and export operations in Japan for over 200 clients across more than 40 countries.

Examples of International Logistics Partners We Have Worked With

We have a proven track record of working with a wide range of logistics providers. As the Attorney for Customs Procedures (ACP), we handle customs-related responsibilities while logistics companies manage transportation and warehousing operations.

- Apex International

- Brink’s

- CEVA Logistics

- Coshipper

- Crane Worldwide Logistics

- DB Schenker

- DGX (Dependable Global Express)

- DHL Express

- DHL Global Forwarding

- Dimerco

- DSV Air & Sea

- Expeditors

- FedEx Express

- FERCAM

- GOTO KAISOTEN Ltd.

- Harumigumi

- Herport

- ICL Logistics

- JAS Forwarding

- Kintetsu Express

- Kokusai Express

- Kuehne + Nagel

- Mitsubishi Logistics

- MOL Logistics

- Nankai Express

- Nippon Express

- OIA Global

- PGS

- Rhenus Group

- Röhlig

- Sankyu

- Sanyo Logistics

- Scan Global Logistics

- Seino Schenker

- SEKO Logistics

- Shin-Ei gumi

- Shiproad

- Sumitomo Warehouse

- UPS

- UPS Supply Chain Solutions

- Yamato Transport

…and many other logistics providers in Japan and around the world.