Fundamentals of Calculating Import Declaration Values Based on Japan’s Customs Tariff Law

In general, for imports (under the Customs Act, referred to as an “Import Transaction”) involving a sales transaction between an overseas seller and a Japanese buyer/importer, it is possible to declare the price using the CIF adjusted basis sales transaction price as the declaration value. This is referred to as the principal method of determination (Customs Tariff Act Article 4, Paragraph 1).

However, in the case of Amazon FBA, Amazon International Sellers bring their goods into the Amazon FC warehouse in Japan while retaining ownership of the goods. In this case, the above principal method cannot be used. Instead, an exceptional method of determination must be used, based on the provisions of Customs Tariff Act Article 4-2 and onwards.

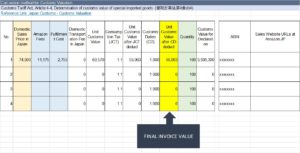

The import declaration value for Amazon FBA shipments is most commonly determined using an exceptional method—specifically under Article 4-4 of the Customs Tariff Law, by applying, on a mutatis mutandis basis, the domestic sales price determination method set out in Article 4-3, which involves deducting certain domestic costs (import duties and consumption tax, Amazon Referral Fee, Amazon FBA Fee, domestic transportation costs, etc.) from the domestic sales price. This calculation method is known as the Deductive Method.

Deductive Valuation Technique

The deductive method based on the domestic sales price follows the formula below:

Step-1)

Domestic Sales Price – Amazon Fees – Fulfillment Cost – Other Domestic Fees (e.g., Domestic Transport, Clearance charge)

For example, Sales Price 74,500 JPY – Miscellaneous Fees (11,175 JPY + 2,755 JPY) = 60,570 JPY

Step-2)

Divide the amount from Step 1 by 1.10 (including 10% Japan Consumption Tax), adjusted for the applicable customs duty rate

For example, 60,570 JPY ÷ 110% = 55,063 JPY

The 55,063 JPY from above is the import declaration price per product.

Required Screenshots as Evidence of Sales Price and Fees

Japan Customs requires sellers to provide clear evidence of the sales price and any deducted fees. The following documents are typically requested:

Evidence of Sales Price:

1. Screenshot of the Amazon.JP Sales Website at [www.amazon.co.jp/dp/ASIN NUMBER]

2. Screenshot from Inventory Management at the Amazon Seller Central

Evidence of Amazon Fees (Referral Fees, Fulfillment Costs, etc.):

1. Screenshot of the Revenue and Cost Simulator

2. Cost Report:

In some cases, you may also be required to submit the Fulfillment by Amazon Cost Report

As your trusted Customs Procedures Attorneys (ACP) in Japan, ACP JAPAN is committed to meticulously preparing all requisite documentation and screenshots for the import declaration process. Depend on our skilled guidance to meet all your customs requirements.

Our ACP Service: The Best Solution for the Japan Importer of Record (IOR) and Exporter of Record (EOR)

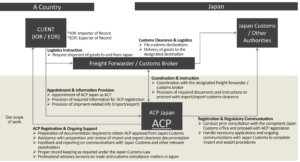

ACP is an effective solution for addressing Importer of Record (IOR) and Exporter of Record (EOR) requirements in Japan. Through our ACP service, non-resident entities located outside Japan are able to import and export goods as Non-Resident IOR and EOR.

Below is an overview of our basic scope of work, together with a diagram illustrating the operational structure of the ACP service. Once ACP registration is completed, the non-resident entity can act as the Importer of Record (IOR) and Exporter of Record (EOR) in Japan.

Scope of Work – How We Can Assist

- Consultation with Japan Customs to support successful ACP registration.

- Liaison with relevant stakeholders, including freight forwarders and Japan Customs, to ensure the smooth and compliant import and export of goods.

- Assistance in preparing and reviewing import and export clearance documentation.

- Support in the calculation of customs value, in accordance with the Japan Customs Tariff Act.

- Assistance with advance rulings on HS classification, customs valuation, and rules of origin.

- Import compliance support for regulated products, including Domestic Administrator (sometimes referred to as “Domestic Representative”) Services under the Product Safety Acts (PSE/PSC) and food-related products regulated under the Food Sanitation Act.

- Support for security export control, including list-based classification, catch-all control assessment, and assistance with export license applications to the Ministry of Economy, Trade and Industry (METI).

- Record-keeping support in accordance with Article 95 of the Japan Customs Law.

- Provision of professional trade and customs advisory services to address and resolve issues that may arise during import or export operations.

**Both import and export activities can benefit from the use of an ACP (Attorney for Customs Procedures). This support is applicable in scenarios where a non-resident acts as the Importer of Record (IOR) for imports and as the Exporter of Record (EOR) for exports.

Three Steps to Initiate Shipments Under the ACP Program:

- Quotation Review to Contract Conclusion: Upon receiving your contact details, we will promptly provide a quotation for your review.

- Commencing the Registration of ACP (Attorney for Customs Procedure) to Japan Customs: This process is generally completed in about two weeks.

- Initiation of First Shipment, Import/Export

Track Record – Attorney for Customs Procedures (ACP) Services

We have supported import and export operations in Japan for over 200 clients across more than 40 countries.