We would like to inform you about a significant revision by Japan Customs, which clarifies the definition of an Importer. This change took effect on October 1, 2023.

With the revision, there has been an increase in cases where foreign corporations must use an Attorney for Customs Procedures (ACP) to become an Importer of Record (IOR) themselves. It is no longer feasible to nominate another entity merely in name as the importer.

In instances other than normal import transactions between an overseas seller and a Japanese buyer, where the importer does not have the authority to dispose of the goods after importation (for example, when a foreign corporation does not become the IOR themselves and nominates a forwarder, customs broker, or another third party who is not involved in the transaction to be the nominal IOR), there is a high probability that approval will not be granted as such nominations are not recognized as legitimate importers, therefore careful attention is required.

As a professional ACP firm, we follow the law to facilitate proper import procedures. You can entrust us with your importation needs with confidence. We look forward to discussing further with you.

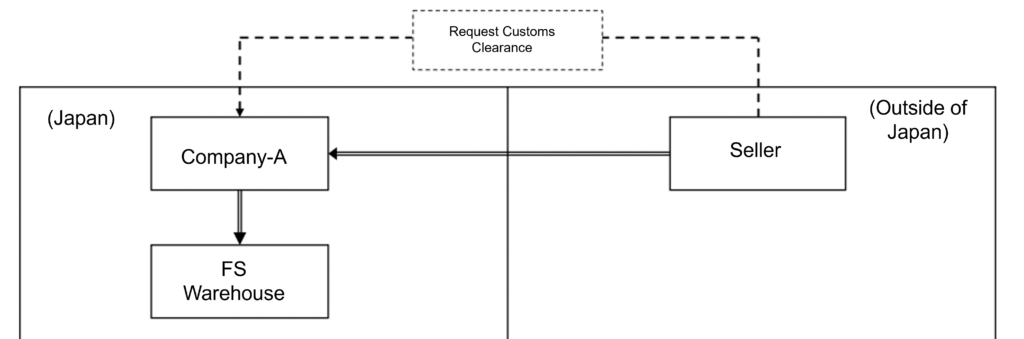

Japan Customs’ Official Guideline for E-Commerce Sellers

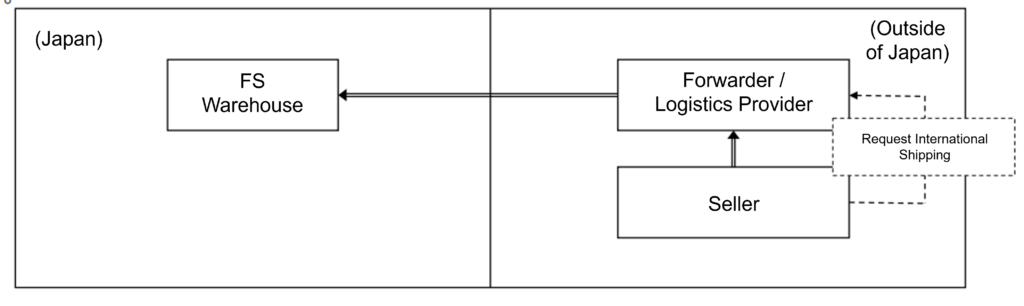

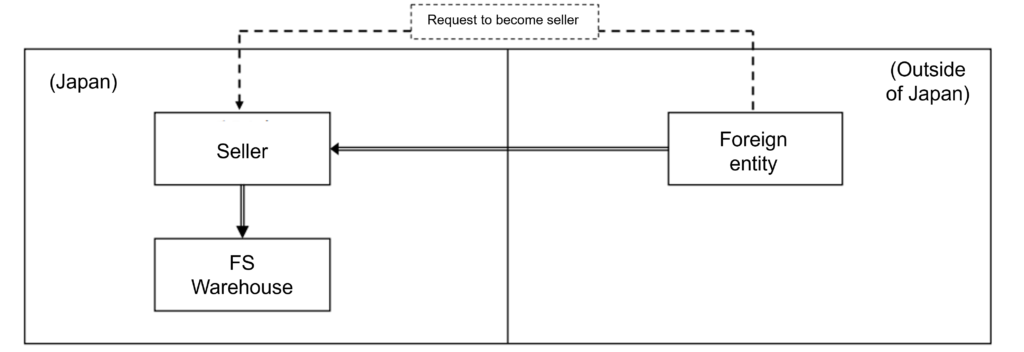

Here is the official guideline from Japan Customs. On page 2 of the leaflet, you’ll see a clear comparison:

- On the left side, which reflects the rule before September 30, 2023, it was allowed for an “Import Agency” (such as a logistics or warehouse company) to act as the Importer of Record (IOR).

- On the right side, from October 2023 onward, the Seller must be the IOR by appointing a Customs Procedures Agent — which is what we refer to as an ACP (Attorney for Customs Procedures).

- Japan Customs: Revision of Import Declaration Items and Attorney for Customs Procedure (ACP) System

- Japan Customs Notice – Available in English, Chinese, Korean, and Japanese

Revisions Effective October 1, 2023:

Definition of the Importer

- Regarding a cargo imported under an import transaction, an importer is equivalent to “a person who imports a cargo” defined in Article 6-1 (1), General Notification of the Customs Act. ….. This means, the Consignee, etc., in the case of imports conducted through normal transactions between an overseas seller and a Japanese buyer

- In the cases other than above, an importer is a Person Having the Right of Disposal of the import cargo at the time of import declaration. If there is another person who acts on the purpose of the import*, that person is also included:

In case of a cargo imported:

– under lease contracts, a person who rents and uses the cargo.

– for consignment sales, a person who sells the cargo in the name of himself/herself (consignee) by accepting the commission.

– for processing or repairing, a person who processes or repairs the cargo.

– for disposal, a person who disposes the cargo.

Case Study: Directives to use ACP

Case 1: Importing Goods Using FS (Fulfillment Services) by Non-resident Sellers

A non-resident seller plans to import goods for sale domestically using FS provided by EC platform operators. At the time of import declaration, there is no sales contract between the seller and the consumer. The seller (non-resident) is the main entity for sales on the EC platform after domestic pickup of the goods. Therefore, the seller, who aims to sell the goods in accordance with the purpose of import, needs to become the import declarant and appoint Attorney for Customs Procedure (ACP) to carry out the import declaration.

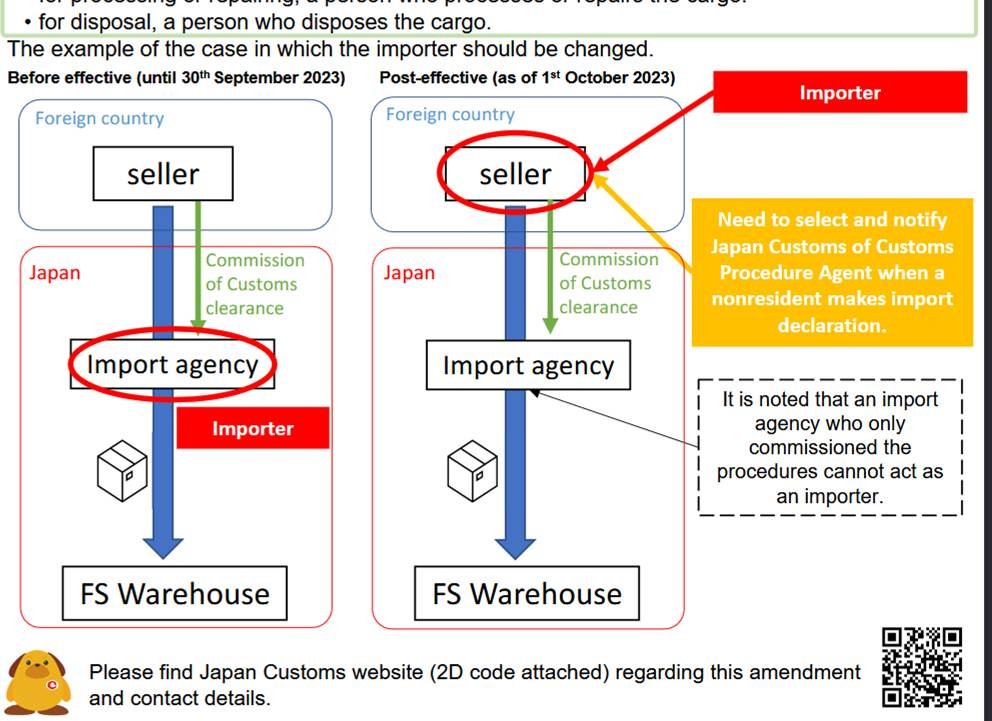

Case 2: Importing Goods Using FS by Non-resident Sellers

A non-resident seller plans to import goods for sale domestically using FS provided by EC platform operators. At the time of import declaration, there is no sales contract between the seller and the consumer. The seller (non-resident) entrusts domestic customs clearance arrangements to Company-A (located in Japan), but the main entity for selling the goods within the domestic market using FS remains the seller (non-resident). It is planned that the seller (non-resident), who intends to sell the goods on the EC platform after domestic pickup, should become the import declarant and appoints Attorney for Customs Procedure (ACP) in accordance with the purpose of import declaration.

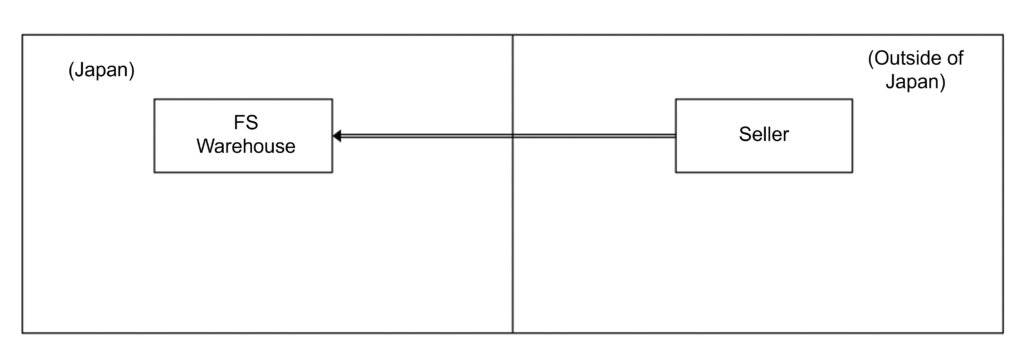

A non-resident seller plans to import goods for sale domestically using FS provided by EC platform operators. At the time of import declaration, there is no sales contract between the seller and the consumer. The seller (non-resident) entrusts the transportation of the goods from overseas sellers to Japan to an overseas forwarder, but the main entity for selling the goods within the domestic market using FS remains the seller (non-resident). It is planned that the seller (non-resident), who intends to sell the goods on the EC platform after domestic pickup, will become the import declarant and appoints Attorney for Customs Procedure (ACP) in accordance with the purpose of import declaration.

Case 4: Importing Goods for Consignment Sales

Goods (consignment sales goods) intended for domestic sale by an assignee who has received consignment sales from a non-resident consignor are imported. The imported goods are stored in an FS warehouse and sold on the EC platform under the name of the assignee. The assignee is the main entity for selling the goods within the domestic market using FS.

Either of the following options is necessary:

The consignor (non-resident) who has the authority to dispose of the consignment sales goods becomes the import declarant, appoints Attorney for Customs Procedure (ACP), and carries out the import declaration.

The assignee (i.e., the seller on the EC platform) who conducts the act of selling on behalf of themselves as the purpose of import becomes the import declarant and carries out the import declaration.

For more information regarding the revised regulations by the Japan Customs, please refer to the following:

(Link: Revision of Import Declaration Items and Attorney for Customs Procedure (ACP) System) Ministry of Finance, Japan Customs July 2023 With the expansion of cross-border e-commerce, the importation of goods for online shopping has increased, leading to a significant number of cases involving the smuggling of illegal drugs and counterfeit goods that infringe upon intellectual property rights. Particularly concerning are instances of tax evasion, where goods imported through fulfillment services (FS) are declared at unreasonably low prices to evade customs duties.

In light of these circumstances, we have conducted a review of the existing system to ensure the continued facilitation of smooth imports while effectively combating smuggling activities and ensuring proper taxation. Effective from October 1, (2023), there will be an addition to the import declaration items under the Customs Law Enforcement Order, requiring the inclusion of the “address and name of the person intending to import the goods” at the time of import declaration.

Furthermore, there will be additions to the declaration items for Attorney for Customs Procedure (ACP), including information regarding the relationship between the declarant and the Attorney for Customs Procedure (ACP). Additionally, it will be mandatory to submit the contractual documents between the declarant and the ACP. For specific details regarding the revisions to the system, please refer to the following reference materials.

Reference (Japan Customs)

Track Record – Attorney for Customs Procedures (ACP) Services

We have supported import and export operations in Japan for over 200 clients across more than 40 countries.

Examples of International Logistics Partners We Have Worked With

We have a proven track record of working with a wide range of logistics providers. As the Attorney for Customs Procedures (ACP), we handle customs-related responsibilities while logistics companies manage transportation and warehousing operations.

- American Overseas Transport (AOT)

- Apex International

- Brink’s

- CEVA Logistics

- Coshipper

- Crane Worldwide Logistics

- DB Schenker

- DGX (Dependable Global Express)

- DHL Express

- DHL Global Forwarding

- Dimerco

- DSV Air & Sea

- Expeditors

- FedEx Express

- FERCAM

- GOTO KAISOTEN Ltd.

- Harumigumi

- Herport

- ICL Logistics

- JAS Forwarding

- Kintetsu Express

- Kokusai Express

- Kuehne + Nagel

- Mitsubishi Logistics

- MOL Logistics

- Nankai Express

- Nippon Express

- OIA Global

- PGS

- Rhenus Group

- Röhlig

- Sankyu

- Sanyo Logistics

- Scan Global Logistics

- Seino Schenker

- SEKO Logistics

- Shibusawa Logistics Corporation

- Shin-Ei gumi

- Shiproad

- Sumitomo Warehouse

- UPS

- UPS Supply Chain Solutions

- Yamato Transport

…and many other logistics providers in Japan and around the world.