Overview

ACP JAPAN specializes in providing Attorney for Customs Procedures (ACP) services to international Amazon sellers, particularly those aiming to sell on Amazon Japan through the Amazon FBA program. By taking on the role of ACP, we empower Amazon sellers to become their own importers (Importer of Record – IOR), efficiently navigate the customs clearance process, and ensure their products reach Amazon’s Japanese Fulfillment Warehouses.

Case Study – Amazon FBA Import

Client Profile:

An Amazon seller dealing in clothing and miscellaneous goods, wanted to start selling on Amazon Japan.

Situation:

The client, an overseas entity without a physical presence in Japan, sought to become the importer and deliver their products to Amazon’s Japanese warehouse. The shipment had already arrived in Japan, but the client was unaware of the need for a Japanese importer and mistakenly believed Amazon would serve as the consignee and importer. UPS, their logistics provider, warned that the shipment would be returned unless a Attorney for Customs Procedures (ACP) was promptly appointed.

Our Approach:

ACP JAPAN quickly responded to the client’s inquiry, finalizing the contract on the same day. We immediately started the ACP registration process, completing it within approximately one week. We also contacted UPS to prevent the return of the shipment, successfully ensuring its retention.

During the registration process, we prepared all necessary import documents, including invoices and import declaration pricing documents, using our tailored templates. Collaborating closely with the client, we completed these documents within one or two days. After document preparation, we worked with UPS’s customs department for a final review, concluding the import declaration process efficiently.

Outcome:

Our success rate in facilitating imports as ACP is impeccable.

While the initial import may take 1-2 weeks due to the ACP registration, subsequent imports proceed without delay. Preparing invoices and import declaration pricing documents for Amazon FBA shipments can be initially time-consuming, but the process becomes more streamlined with experience. For additional insights, refer to our article: [Method for Calculating Import Declaration Prices for Amazon FBA Shipments].

If there is an obligation to pay consumption tax to the tax office under Japanese law, we can collaborate with our partner tax accounting firms to support (1) registration as a qualified consumption tax invoice issuer, and (2) the filing of final consumption tax returns, including the deduction of import consumption tax as input tax credits (or refunds, if applicable).

Our ACP Service: The Best Solution for the Japan Importer of Record (IOR) and Exporter of Record (EOR)

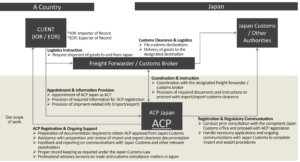

ACP is an effective solution for addressing Importer of Record (IOR) and Exporter of Record (EOR) requirements in Japan. Through our ACP service, non-resident entities located outside Japan are able to import and export goods as Non-Resident IOR and EOR.

Below is an overview of our basic scope of work, together with a diagram illustrating the operational structure of the ACP service. Once ACP registration is completed, the non-resident entity can act as the Importer of Record (IOR) and Exporter of Record (EOR) in Japan.

Scope of Work – How We Can Assist

- Consultation with Japan Customs to support successful ACP registration.

- Liaison with relevant stakeholders, including freight forwarders and Japan Customs, to ensure the smooth and compliant import and export of goods.

- Assistance in preparing and reviewing import and export clearance documentation.

- Support in the calculation of customs value, in accordance with the Japan Customs Tariff Act.

- Assistance with advance rulings on HS classification, customs valuation, and rules of origin.

- Import compliance support for regulated products, including Domestic Administrator (sometimes referred to as “Domestic Representative”) Services under the Product Safety Acts (PSE/PSC) and food-related products regulated under the Food Sanitation Act.

- Support for security export control, including list-based classification, catch-all control assessment, and assistance with export license applications to the Ministry of Economy, Trade and Industry (METI).

- Record-keeping support in accordance with Article 95 of the Japan Customs Law.

- Provision of professional trade and customs advisory services to address and resolve issues that may arise during import or export operations.

**Both import and export activities can benefit from the use of an ACP (Attorney for Customs Procedures). This support is applicable in scenarios where a non-resident acts as the Importer of Record (IOR) for imports and as the Exporter of Record (EOR) for exports.

Three Steps to Initiate Shipments Under the ACP Program:

- Quotation Review to Contract Conclusion: Upon receiving your contact details, we will promptly provide a quotation for your review.

- Commencing the Registration of ACP (Attorney for Customs Procedures) to Japan Customs: This process is generally completed in about two weeks.

- Initiation of First Shipment, Import/Export

Track Record – Attorney for Customs Procedures (ACP) Services

We have supported import and export operations in Japan for over 200 clients across more than 40 countries.

Examples of International Logistics Partners We Have Worked With

We have a proven track record of working with a wide range of logistics providers. As the Attorney for Customs Procedures (ACP), we handle customs-related responsibilities while logistics companies manage transportation and warehousing operations.

- Apex International

- Brink’s

- CEVA Logistics

- Coshipper

- Crane Worldwide Logistics

- DB Schenker

- DGX (Dependable Global Express)

- DHL Express

- DHL Global Forwarding

- Dimerco

- DSV Air & Sea

- Expeditors

- FedEx Express

- FERCAM

- GOTO KAISOTEN Ltd.

- Harumigumi

- Herport

- ICL Logistics

- JAS Forwarding

- Kintetsu Express

- Kokusai Express

- Kuehne + Nagel

- Mitsubishi Logistics

- MOL Logistics

- Nankai Express

- Nippon Express

- OIA Global

- PGS

- Rhenus Group

- Röhlig

- Sankyu

- Sanyo Logistics

- Scan Global Logistics

- Seino Schenker

- SEKO Logistics

- Shin-Ei gumi

- Shiproad

- Sumitomo Warehouse

- UPS

- UPS Supply Chain Solutions

- Yamato Transport

…and many other logistics providers in Japan and around the world.

Why choose us?

We specialize in navigating complex issues at the intersection of customs procedures and taxation—an area where our ability to offer practical, comprehensive support from both perspectives sets us apart. Understanding the close relationship between customs duties and national taxes (especially, Japan Consumption Tax – JCT), and addressing both in an integrated manner, is crucial in the context of international trade.

- Customs and International Trade Professionals – Led by our CEO, Mr. Sawada—Certified Customs Specialist and former KPMG professional—ACP JAPAN provides expert-level support in Customs and international trade. Mr. Sawada also serves as an external expert for the World Bank’s B-READY project in the field of customs and international trade.

- Full Compliance with Japanese Customs Law – We ensure full adherence to Japanese Customs Law, including Importer of Record (IOR) structure, HS code classification, and customs valuation. We assist in preparing all essential shipping documents for non-resident entities.

- One-Stop Support for ACP and JCT Tax Representative Services – In collaboration with trusted partner tax accountants, we provide comprehensive support for both customs procedures through the Attorney for Customs Procedures (ACP) and Japan Consumption Tax (JCT) filings through the JCT Tax Representative.

- Multilingual Communication – Our team communicates fluently in English, Japanese, and Chinese, offering smooth coordination with global clients and authorities in Japan.

- Support for Regulated Products – Our ACP/IOR partnership system can manage regulated items, including cosmetics, PSE-products, foodstuffs, and tableware.

- Trusted by Global Clients – Serving around 100 ACP clients annually, including many Amazon sellers, we’re a certified provider on Amazon SPN (Service Provider Network) under Trade Compliance.

FAQ for ACP (Attorney for Customs Procedures)

What is the role of ACP (ACP Japan)?

- Representation: ACP (ACP Japan) represents the foreign importer and liaises with Japan Customs and the Forwarding Company/Customs Broker.

- Documentation and Compliance: ACP assists in preparing essential import documents (e.g., Invoices) in compliance with Japan Customs Law and formally requests the Customs Broker to proceed with customs clearance.

- Expert Consultation and Troubleshooting: We are a team of legal experts in Customs Laws, providing direct consultations with Japan Customs to ensure compliance and address issues, including troubleshooting unique challenges in non-resident imports.

How long time does it require to get ACP’s registration?

It will take approximately 2 weeks until getting an approval from Japan Customs Office.

The breakdown of the task is as follows.

- Prepare the necessary documentation between us

- Start pre-consultation with Japan Customs Office and proceed initial review

- Submit paper-based set of application documents to Japan Customs Office for final review

What kind of documents to be necessary for ACP application?

Not limited, but for instance – Power of Attorney, Company Registry, The calculation method of Customs Valuation, Catalog of the import goods, business/logistic flow

ACP can handle all kinds of goods?

Whereas many ACP service providers do not handle regulated items, our company’s competitive advantage stems from our ability to manage such products. We can support regulated items, including cosmetics, PSE-regulated products, foodstuffs, and tableware.

Which regions in Japan are we covering?

Any region in Japan, we can handle.

What is difference between ACP and IOR?

ACP is not the Importer. ACP enables non-resident entities to become IOR (Importer of Record).

We’re a reliable ACP service provider for Amazon FBA’s seller

In recent, we’ve been supporting many import projects of goods related to the Amazon-FBA program. If you are looking for a reliable ACP service provider, please let us know.

Guidance by Amazon

According to the seller central website in Amazon, there is guidance by Amazon that a non-resident entity needs to appoint an ACP or IOR. You may check on this “Non-resident requirements”. Also, you can check the document developed by Amazon “Understand ACP and IOR guidance”. —–

Our ACP Service (Attorney for Customs Procedures)