Japan Consumption Tax (JCT)

July 24, 2021

What is ACP? – Attorney for Customs Procedures

January 29, 2022

What is IOR? – Importer of Record

January 29, 2022

Recent Posts

- Only the Importer of Record is eligible for the Deduction of Import JCT – Japan Consumption Tax

- Japan Security Export Control – Compliance Establishment

- Japan JCT Tax Obligations for Foreign Corporations with a Capital of Over 10 Million Yen (Amendments to the Consumption Tax Law, April 2024)

- Urgent Compliance Alert for E-Commerce Sellers: Avoid Penalties with Japan’s New Import Regulations – Act Now!

- October 2023: Introduction of Two New Systems in Japan – (1) Switching from IOR Provider to ACP & (2) QIS: Japan Consumption Tax’s Qualified Invoice System

- Navigating the Intricacies of Importing Tech Goods to Japanese Data Centers

- Japan Customs Reform | Clarification of Importer Definitions

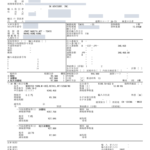

- Taxes on Imports: Customs Duty and Japan Consumption Tax (JCT)

- Import Permit Document and Alert on IOR Service

- New Japan Qualified Invoice System and import JCT (Japan Consumption Tax)

- ACP Import under VMI – Vendor Managed Inventory

- Started a new IOR (Importer of Record) Service for Food/Kitchen Tools, Tumblers, Cutlery

- ACP Service – Attorney for Customs Procedure

- ACP Japan, became Amazon’s SPN provider as qualified ACP service provider.

- Japan IOR Service